BUDGETING

There are many benefits to good money management, including lower anxiety, better relationships and better overall well-being. Creating a budget is the first step to taking control of your finances and developing good money habits.

Why do a budget?

Completing a budget will show you what you currently spend your money on and how much, if anything, is left over for savings. You can then consider what your priorities are and make decisions about discretionary spending.

A budget lets you see if you are spending more or less than you earn, can help you get on top of bills and show you how much is available to save towards future goals.

Setting some goals so you have a reason to save is a great motivator for completing a budget.

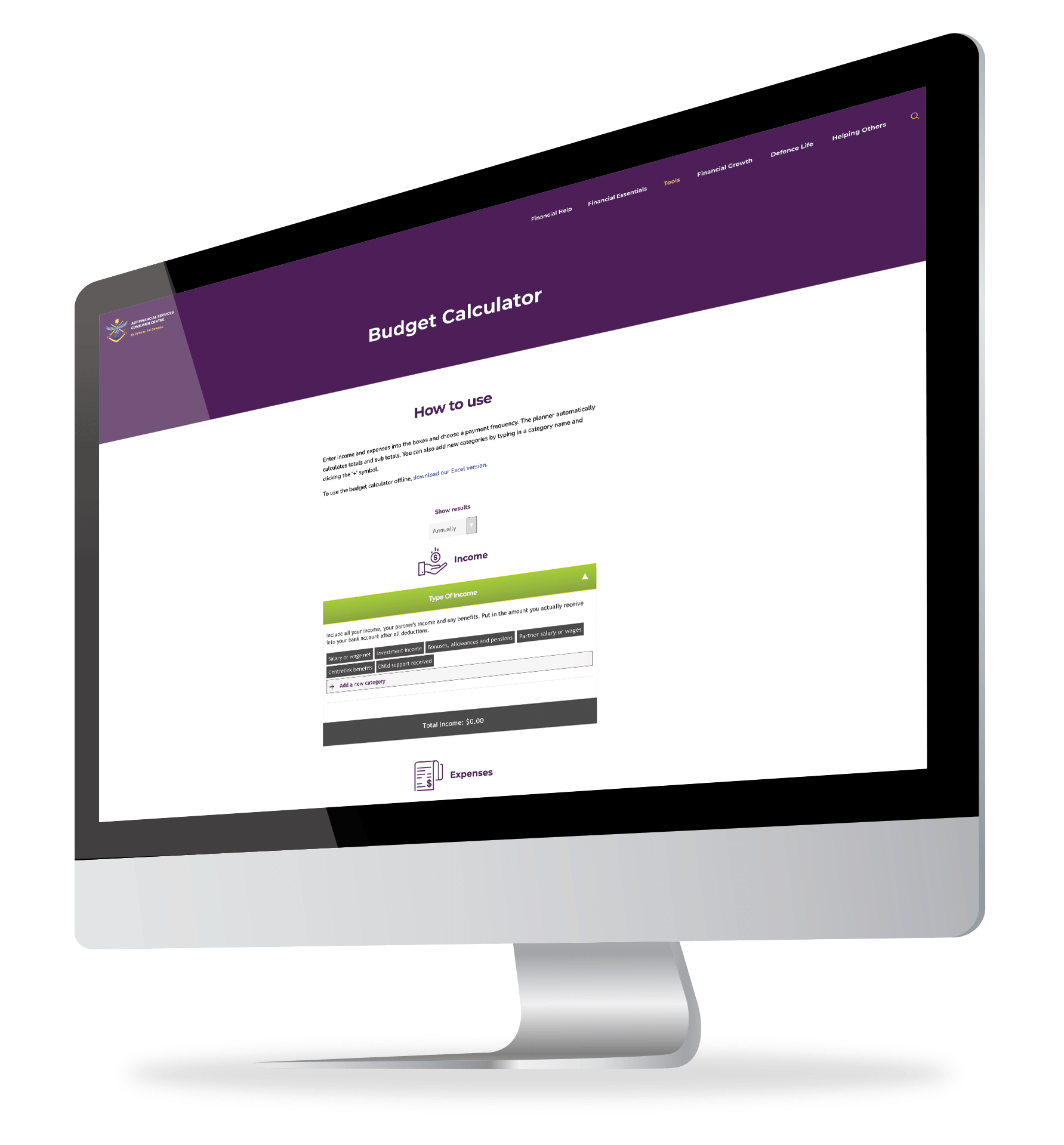

Budget Calculator

The easiest way to do a budget is with a budgeting tool, like our budget calculator. Complete online or download the Excel version to complete on your own device. The first time you do a budget, expect to spend a bit of time getting it right. Choose a time you’re less likely to be interrupted so you can focus.

How to do a budget?

You can prepare a budget for any period of time; a fortnight, a month, a year. We suggest initially budgeting for a whole year, so that you capture expenses you pay less frequently, like utilities, car rego and insurances. Completing an annual budget also helps you better manage variable expenses. For example, your electricity bill may be higher in winter or summer, depending on where you live and how much you rely on heating and cooling.

Tips to help when completing your budget

Refer to your bank statements

Use your bank statements to account for regular income, such as salary, government benefits and investment income; and expenses, such as rent or mortgage, food and other regular outgoings. If you use a credit card, you’ll need to go through your credit card statements as well.

Track your cash spending

Make sure you also track cash spending especially if you are in a habit of withdrawing cash from an ATM or through EFTPOS when you make a purchase. Use a spending tracker app or carry a small notebook and pen with you to record each time you pay for something with cash. When you know what you’re spending cash on, you can add the details to your budget.

Convert to pay periods

When you’ve completed your annual budget, divide each amount by the number of pay periods in a year. For example, ADF members are paid fortnightly so divide each annual income and expense amount by 26. This will let you to clearly see how much you need to put away each pay to meet your expenses. If you are using a budgeting tool it may do this for you.

Surplus or deficit

When you’ve completed your budget, it should show that you either have surplus income or that you are spending more than you earn and are in deficit. Consider whether this reflects your reality. For example, if your budget says you should have a surplus but you haven’t saved any money, then chances are you’ve missed something. If on the other hand it says you’re in deficit but you have no debt, you may have overestimated your expenses or underestimated your income.

It’s not easy getting it right the first time around so be patient and methodical and keep working on it until you have a budget that accurately represents your income and expenses. It’s definitely worth the effort.