EMPLOYMENT PACKAGE ESTIMATOR

This is an employment package estimator that will only be as good as the numbers you put in. We are all individuals and value things differently.

This tool can help you think about the range of benefits a career in Defence affords you. It is not intended to be your only source of information when making important personal decisions, but it may form part of the equation.

How to use this estimator?

This estimator will help you identify the extra benefits a career in Defence affords you. Think of this estimator as an introduction, not an exhaustive list, you may receive additional benefits not outlined here. Think about the value of all the costs covered through your Defence employment, which a civilian would usually pay for out of their own pocket. You will need a current payslip as a starting point. We ask you to estimate some benefits yourself because we are all different, but it’s worth spending a bit of time to understand what a career in Defence is really worth.

Who is this estimator for?

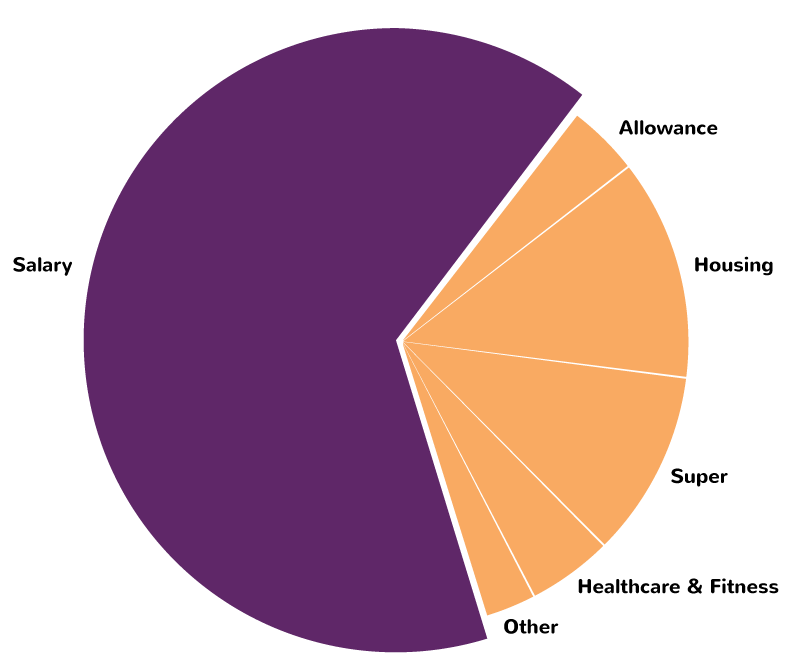

In addition to a competitive salary, ADF members receive a range of other allowances and benefits. These benefits, such as subsidised housing, medical and dental care, fitness facilities, and education, have a financial value. The fact is, as an ADF member, you won’t have to put your hand in your pocket for much, you’ll be very well looked after. This guide will help current permanent ADF members and leaders who want to gain a better understanding of the true value of the ADF remuneration package. It may also be useful for potential ADF members and recruiters.

Service:

Primary superfund:

Housing:

Medicare levy exemption:

(If unsure, choose full)

Package Element