IMMEDIATE MONEY HELP

If you are you behind on your bills, struggling with debt repayments or unable to cover basic living expenses, there are organisations that can help you manage.

Can I get grants or loans to help me with my debts?

Relief Trust Funds

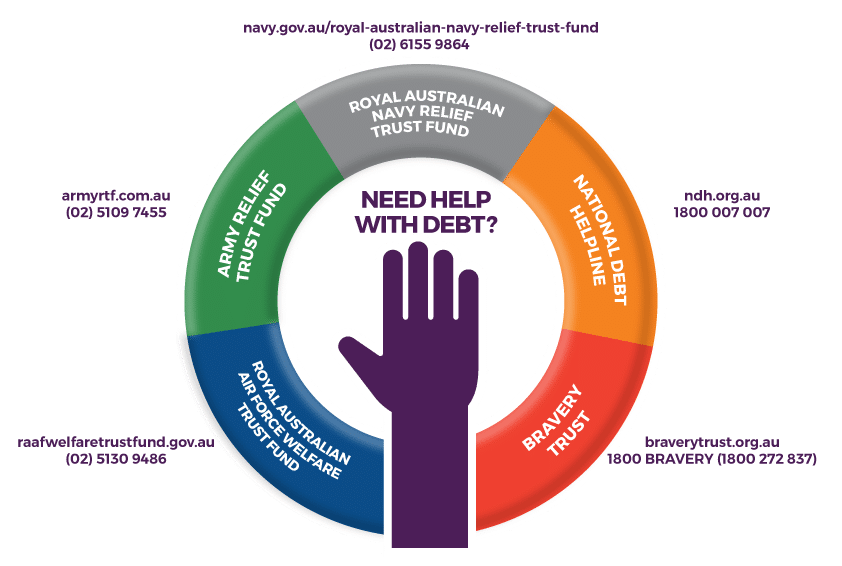

Each service (Navy, Army, Air Force) has a trust fund providing loans and grants to ADF members facing financial hardship. To contact the appropriate source, go to:

- Royal Australian Navy Relief Trust Fund or talk to your local RAN Ship or Establishment RANRTFO/PERSO

- Army Relief Trust Fund, call 02 5109 7455 or email [email protected]

- Royal Australian Air Force Welfare Trust Fund or call (02) 5130 9486

A Financial Counsellor can help

A financial counsellor is a qualified professional offering free, confidential, and independent assistance for those facing financial hardship. Unlike financial planners or advisers who work with investments, financial counsellors provide support without selling products. Based in community organisations and government agencies across Australia, they can help you:

- prioritise debts

- negotiate with creditors

- access dispute resolution

- develop budgets

- access grants or concessions

- understand your rights

- get legal help when needed

To find a financial counsellor, call the National Debt Helpline on 1800 007 007 or visit their website. Want to talk with someone who knows the ADF context? The Bravery Trust also offers Financial Counselling. Call 1800 BRAVERY or visit their website.

Frequently Asked Questions

If you have financial difficulties, problems with debt or can’t manage on your income, a financial counsellor may be able to help. Financial counsellors do not charge a fee.