2022-2023 ANNUAL REPORT

Welcome to the ADF Financial Services Consumer Centre’s (the Centre) 2022-2023 Annual Report. A quick easy to read online snapshot of our work during the year noting some of our bigger achievements. It has been our busiest year ever with face-to-face education bouncing back to record numbers after the disruptions of the past few years and some large improvements in our digital services.

By Defence, For Defence.

Our Charter was reaffirmed by the CDF this year

The Centre operates pursuant to a Charter issued by the Chief of the Defence Force (CDF). In May 2023, our Charter was reaffirmed by the current CDF General Angus Campbell, AO, DSC.

The Charter gives the Centre three tasks:

Project Showcase

Website Redesign and Rebuild

The Centre's website offers financial education tools and resources tailored for ADF members and their families. It’s an important asset which provides 24/7 access to information and supports our education programs. In a technology driven world, we are continually adapting to meet the needs of our audience and their requirements.

In April 2023, the Centre launched a redesigned and rebuilt website. To understand how our site was being used by ADF users and how we could improve the information and onsite experience, we conducted an audit of the site structure, content, user journey patterns and site performance; as well as capturing feedback from users.

Our conclusion was that we needed to evolve the website focus from being a ‘content-delivery’ website to being more ‘user-needs’ focused. As a result, we redesigned the user interface, content taxonomy and user experience to be more relevant and useful to the ADF users when they come to the website looking for financial education and support.

The site’s user-interface and branding design was also improved to make it an easy and pleasant experience. With the site’s rebuild, we implemented a more comprehensive Search Engine Optimisation (SEO) strategy, an improved reporting and analytics capability, improved website security, and ensured better integration with the Centre’s face-to-face activities. An example of this was the incorporation of different QR codes into printed education materials. These QR codes provide an easy and digital avenue for audiences to directly access relevant information and support pages on our website.

The response from our website users to the new website redesign has been positive, with a doubling of the time spent on the new website vs the old site, reading the pages, support materials and tools.

Users are spending over 2x more time on our new site

Financial Counselling

Over the last 3 years, the Centre has taken an active interest in financial counselling and how this can assist serving and ex-serving ADF members who find themselves in financial difficulty, complementing our financial education.

Financial counsellors are qualified professionals who provide information, advice and advocacy to people in financial difficulty; they are not financial planners or financial advisers. Financial counselling services are always non-judgmental, free, independent and confidential and work alongside the individual by assisting them to understand their financial situation, rights, responsibilities and choices.

Community based financial counsellors are located around the country for face-to-face appointments and are available to anyone in financial difficulty. If you’d like to talk to a financial counsellor, go to ndh.org.au or call 1800 007 007. If you simply want to have a look at where to find one near you, go to moneysmart.gov.au/managing-debt/financial-counselling

Bravery Trust delivers a phone and online based financial counselling service. Their financial counsellors can be contacted directly by emailing [email protected] or phoning (03) 9957 5755.

Highlights and Achievements

e-Newsletter

Your Money and You is the monthly e-Newsletter produced by the Centre containing blog articles and important updates for Defence members and their families. The e-Newsletter is distributed to a list of direct subscribers; this list grew 28% this year; and to internal Defence groups at the request of the Services. The Centre produced 11 editions in 2022-2023 and achieved an average open rate of 34.25% - exceeding the industry benchmarks of 27%[1]. The content developed is relevant and engaging to our audience and reflects the changing consumer and financial landscape. The cumulative page views on the Centre’s website for all article content has surpassed 15,000 views (20% of total site content) and has achieved an average time on page of 3min 21sec for article engagement for this period.

Subscribers growth

average open rate

article views

editions

Popular Topics

[1] Campaign Monitor 2022 Email Benchmarks by Industry

Education Programs

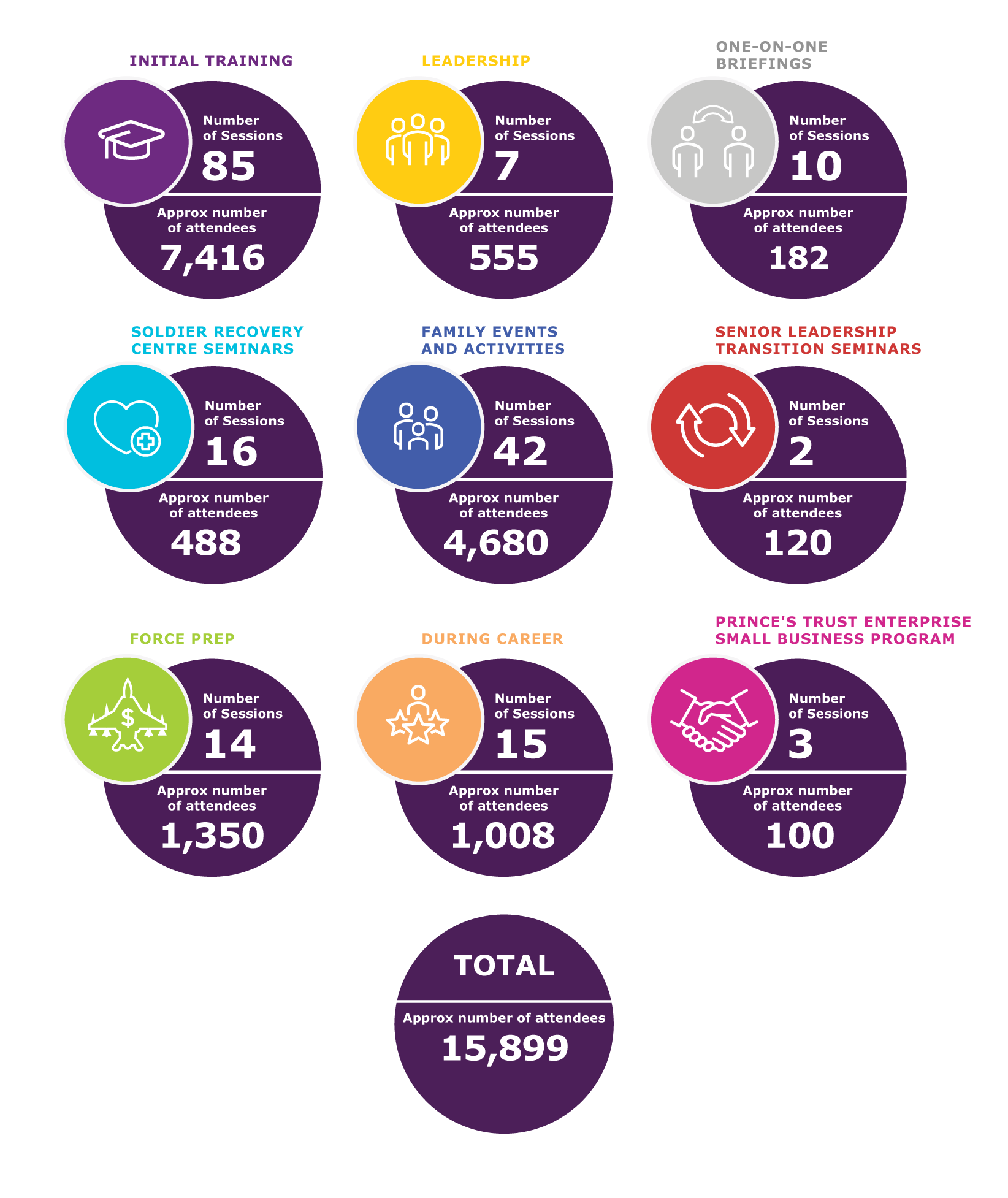

Our biggest year ever for face-to-face education

Our program of face-to-face education seminars has bounced back from the disruptions in 2020-21 and we have had our biggest year ever with around 16,000 people attending. Here is a breakdown by our main seminar types.

Transition Stakeholder Forums

The Centre continued to support the Joint Transition Authority (JTA) Stakeholder Forums throughout 2023. These Forums, held the day before certain JTA Transition Seminars, provided an opportunity for the Centre to raise awareness of our services and support with those key stakeholders involved in the transition of ADF members. The Forums evolved throughout 2023 and have become more of a two-way conversation, providing an opportunity for the Centre to gain feedback on where we can improve our support to ADF members and their families.

First Nations Development Program

This year the Centre has reviewed and enhanced the financial education component delivered to the various Services’ First Nations Development Programs. The Centre has worked closely with the Indigenous Consumer Assistance Network (ICAN) to develop a highly interactive skills-based workshop that is specifically designed to enhance and build financial wellbeing. In addition to the workshop the Centre worked with participants to provide a bespoke education service specific to their circumstances. This includes a referral for those students who may require specialised support.

Deployment

The Centre routinely supports courses provided for deploying personnel with financial education; our involvement in these sessions consists of a short presentation, based on the Centre’s Deployment Checklist, followed by questions which members may ask publicly or privately after each session. We also provide extensive online resources and the opportunity for members to contact us via our website about any financial issues that concerns them, either before or during their deployment.

The Centre’s objective is to encourage participants to review their financial and related legal affairs before deploying. This includes defining personal and family financial goals, preparing a budget, understanding military superannuation/death and invalidity arrangements, preparing a Will, completing their income tax return and importantly, taking the opportunity to build financial knowledge, independence and capability.

Financial Advice Referral Program

The ADF Financial Advice Referral Program is designed to connect ADF members and their families with licensed financial advisers who have declared in writing to Defence that they do not receive any forms of conflicted remuneration (such as third-party commissions, asset fees or other product sales incentives). There are currently 29 individual advisers from across Australia participating in the Program.

During the year we reviewed, using the Australian Securities and Investments Commission's Financial Advisers Register, the compliance by our listed advisers with the principal criteria required on that site.

These include the name of each adviser’s current Australian Financial Services Licence holder, compliance with mandatory educational standards and compulsory professional development requirements and disciplinary/banning actions.

Pleasingly, there were no breaches of the listing criteria.

What questions do people ask us?

We’re glad you asked. We answer lots of questions from members and their families at our face-to-face education seminars. We also get online questions through our website. This year we received nearly a question a day. This is a rough breakdown of the most popular topics: