Sustainability – The claims people make

May 16, 2023

Gambling designed to keep you gambling

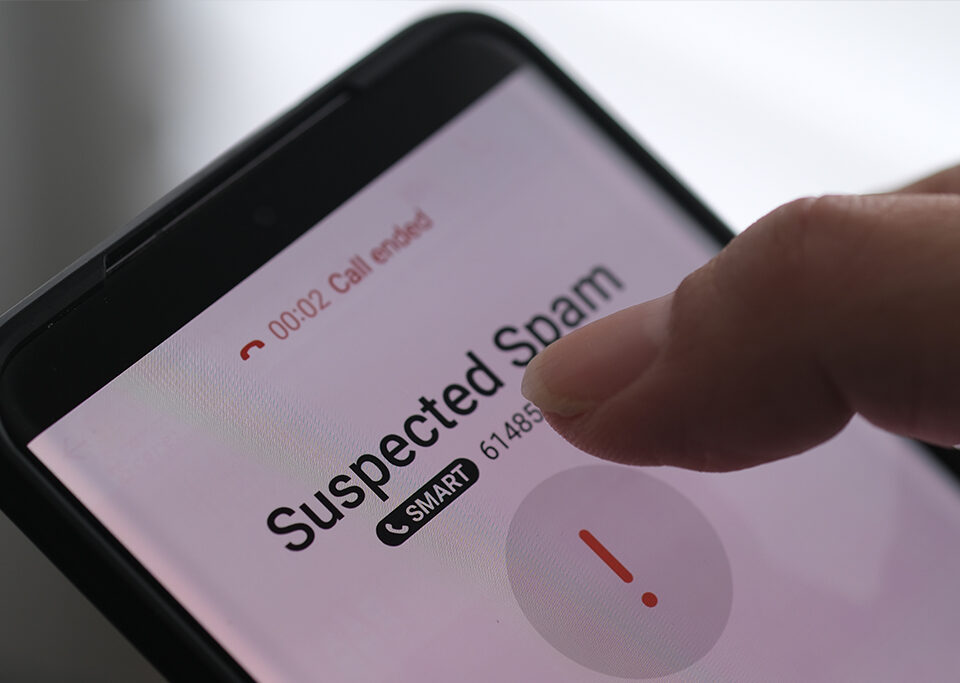

June 16, 2023We’ve written a lot about scams in this newsletter. We do so because the types, frequency and sophistication of scams are growing at an alarming rate. And we know from our many interactions with ADF members and their families that some of them have been scammed, often losing significant amounts of money.

According to the latest Targeting Scams report from the Australian Competition and Consumer Commission (ACCC), at least $3 billion was lost to scams in Australia in 2022. At an individual level, losses rose in that year by more than 50% to an average of almost $20,000 per person. Sadly, in many cases, victims lost their life savings.

According to the ACCC, the top contact methods used by scammers are text messages (33%), phone calls (29%) and emails (22%).

Importantly, the traditional bank transfer is still the most commonly used payment method to scammers. This fact has prompted increased focus by the Australian Securities and Investments Commission (ASIC) on the efforts of Australian banks to thwart the efforts of scammers to use and abuse the banking system.

According to ASIC’s latest Scam Prevention Report (April 2023), while it appears that some progress has been made by the banks in recent years, there is still much to be done to improve their anti-scam processes. In the meantime, here is the disturbing reality reported by ASIC:

- Banks customers are overwhelmingly the bearer of scam losses, accounting for 96% of total scam losses across the banks

- Collectively, the banks detected and stopped a low proportion of scam payments made by their customers (approximately 13% of scam payments)

- The reimbursement and/or compensation rate varied but was low across the individual banks, ranging from 2% to 5%

- Customers who made a complaint were more likely to receive some form of compensation payment from their bank, compared to customers who did not

- Across three banks for which data was available, reimbursement and/or compensation was paid in only around 11% of the cases where there was a scam loss

Clearly, a key conclusion from these facts and figures is that if you’re scammed through your bank, the likelihood of being compensated or reimbursed is not high, to say the least. Therefore, it’s important to take preventative steps to ensure this doesn’t happen to you. Here are three actions to minimise your chances of being scammed:

STOP – Take your time before you give money or personal information

THINK – Ask yourself if the message or call could be a scam

PROTECT – Act quickly if something feels wrong by immediately contacting your bank and reporting your experience to Scamwatch.

These steps might seem pretty obvious and simple. You might even be asking yourself “doesn’t everyone do these things?”. Apparently not….which is why scamming is a growth industry and scammers are managing with relative ease to separate so many Australians from their hard earned savings.