ANNUAL REPORT 2023-2024

Welcome to the ADF Financial Services Consumer Centre’s (the Centre’s) Annual Report 2023-2024. A quick easy to read online snapshot of our work during the year noting some of our bigger achievements. It has been our busiest year ever with face-to-face education bouncing back to record numbers after the disruptions of the past few years. Some particular highlights were improvements to the content and delivery of our face-to-face education, improvements in our digital services including our website and e-newsletter; the continuation of a trial aimed at making financial counselling more accessible; and improvements to the education for First Nations program participants.

Financial Education

Improving our face-to-face education content

We have conducted a detailed review of our face-to-face education series to ensure greater engagement and relevance at every stage of the ADF career.

Our review has put the spotlight on financial wellbeing and resilience, bringing renewed opportunity for members to engage with our education at any stage of their career. The sessions range from finding out about basic money and financial systems to re-establishing knowledge and practices to take members through the varied stages of their lives in and beyond Defence.

Our during career sessions have taken on additional vigour with the opportunity to be part of a workshop model which goes beyond a briefing style and allows members to link financial concepts and goal setting to life priorities and personal decision making.

To support leaders, welfare and personnel support officers and others who support the welfare of ADF members and their families we’ve renewed the focus on Facilitating Financial Fitness, providing links to resources and information.

Some sessions in the series use workbooks which capture key aspects of the financial education for that session. These workbooks can assist the ongoing building of knowledge by revisiting key concepts, sharing information with team members, or simply as a reminder about ways to get and be financially fit.

We have also refined, with the help of a professional in education for First Nations people, the support we provide to Defence’s Indigenous Development Programs and Pre-Recruitment Programs. This refinement includes a new workbook and the increased use of practical activities with the aim of increasing the engagement and effectiveness of the sessions.

Workbooks for some of our sessions are now available on our website. Members can download the workbook, save it on the computer or print it to work through it when time permits. They can come back to the workbook(s) at any time during their career and even share them with family and friends!

Our Biggest Year So Far

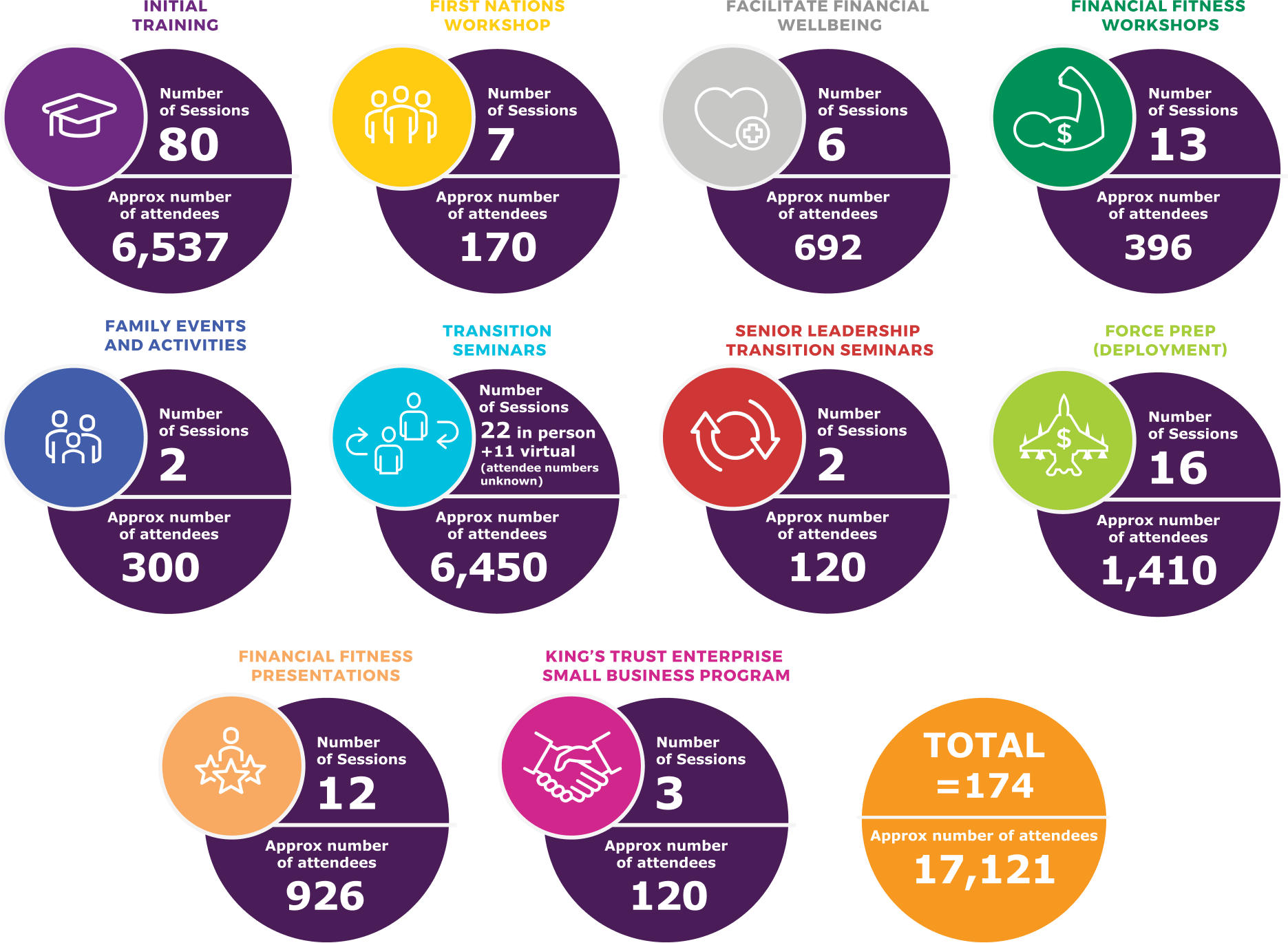

How much face-to-face education did we deliver?

We conducted almost 200 seminars for over 17,000 people. Here is a breakdown by our main seminar types.

What did people learn from us?

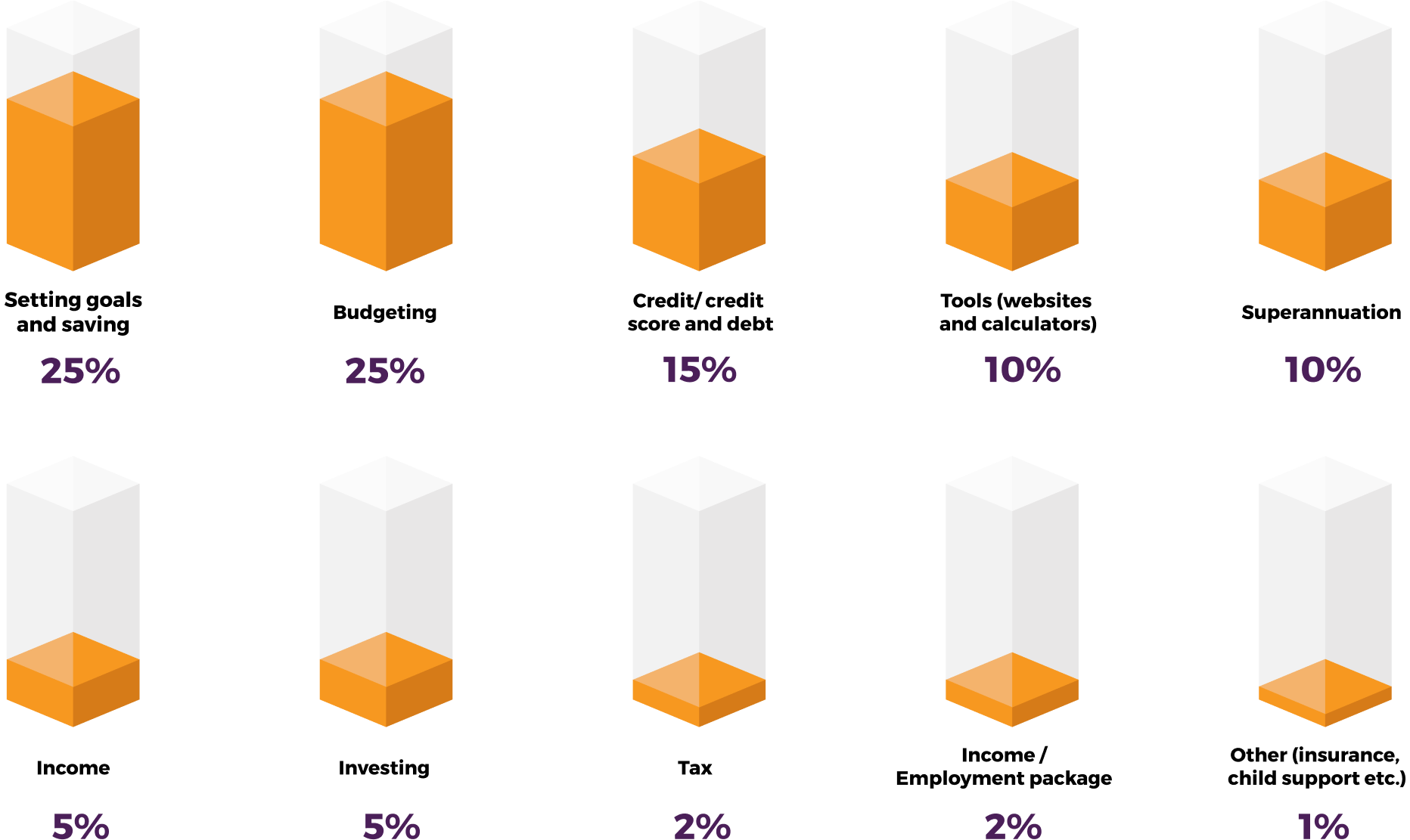

Feedback from the Centre's financial education sessions is vital to help us improve ways to educate members. When we delivered some of our education sessions we asked people to write down one thing that stood out for them during the session. The responses are by definition subjective but there are some common trends that are worth considering.

Depending on the cohort, there was some variation, but overall, the most common topics and related approximate percentages were:

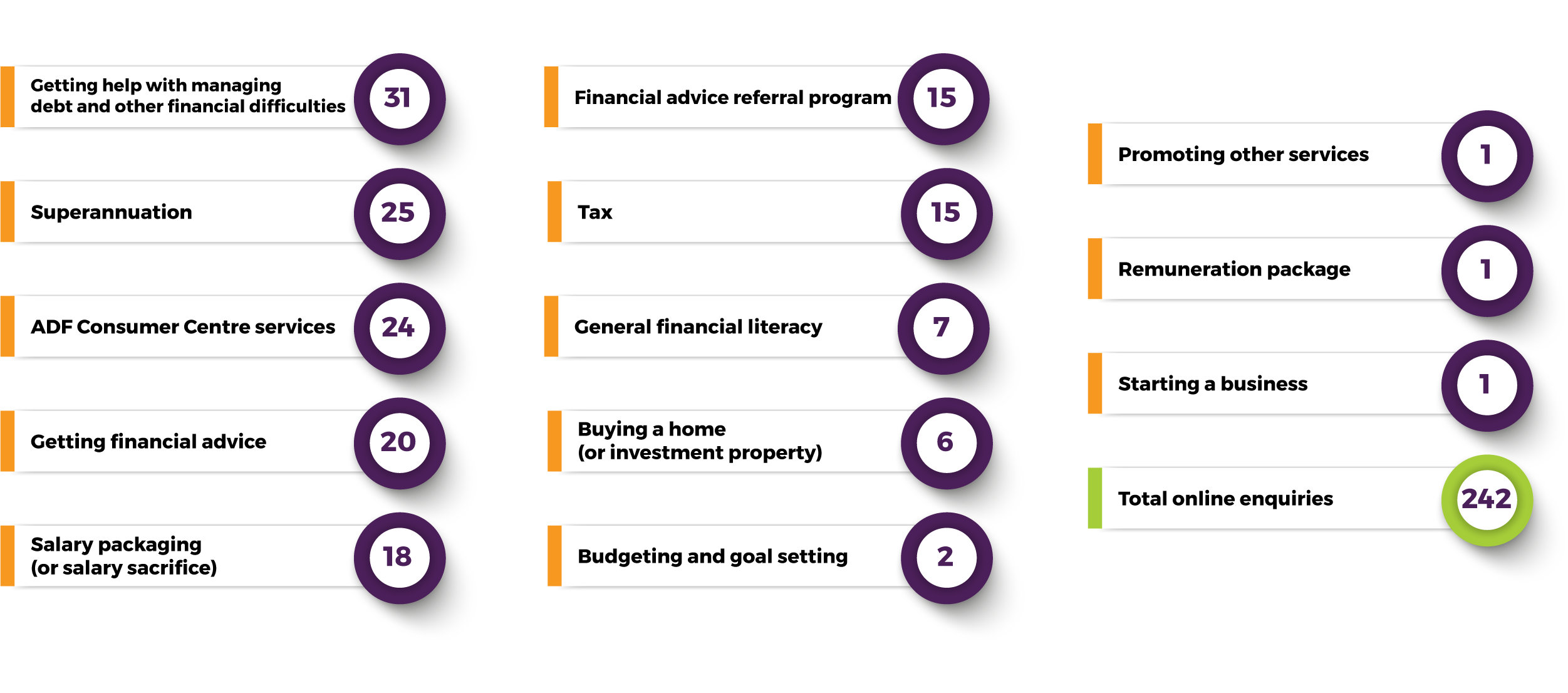

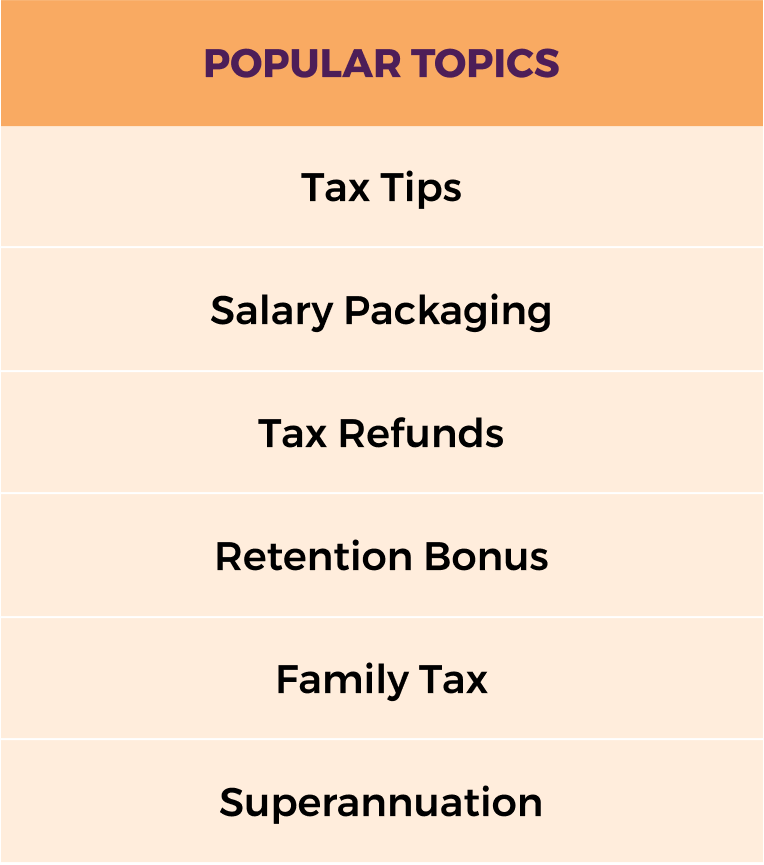

What questions do people ask us?

We’re glad you asked. We answer lots of questions from members and their families at our face-to-face education seminars. We also get online questions through our website. This year we received nearly a question a day. This is a rough breakdown of the most popular topics:

Highlights and Achievements

Website Improvements

The Centre's website has become a vital component of our education program. It provides 24/7 access to financial education, tools and resources specifically designed for ADF members and their families. As well as an online enquiry service. Our site is regularly updated to meet the evolving needs of our audience. The current version of the site was launched in April 2023. Since then it has garnered almost 100,000 visits. Monitoring these visits has provided valuable insights into user behaviour and engagement. These insights have been instrumental in making ongoing updates to enhance the experience for visitors to the site and the quality and tailoring of our educational offering for ADF members and their families. This year we have added interactive elements on the site and seminar materials.

The website has recently bolstered its user engagement efforts by introducing interactive tools such as the Financial Wellness Quiz, designed to assess users' financial health and offer tailored recommendations based on their results. We are continuing to develop quiz opportunities over the next year. The additions reflect our commitment to providing practical resources that align closely with users' financial goals.

The integration of QR codes into seminar materials has streamlined access to the website and its array of resources. Attendees can now conveniently scan QR codes during or after seminars to explore relevant content, enhancing their learning experience and facilitating deeper engagement with financial education materials. These initiatives collectively enhance accessibility and usability, reinforcing our dedication to empowering users with valuable financial knowledge and tools.

Enhancements have also been made to strengthen the site's security, incorporating an additional layer of protection to safeguard user information and ensure a secure browsing experience.

As a result of the website enhancements, we've observed an increase in users navigating through multiple pages and engaging with the content for an average of 2.5 minutes or more.

Users are spending at least 2.5 minutes on the site

Spreading the word wider with our e-Newsletter

The Centre produces a monthly e-Newsletter, Your Money and You, containing articles and important updates for Defence members and their families. The e-Newsletter is distributed to a list of direct subscribers; this list grew 10% this year; and to internal Defence groups at the request of the Services. The Centre produced 11 editions in 2023-2024 and achieved an average open rate of 33% - exceeding the industry benchmarks of 27%¹. We aim to create content that is relevant and engaging for our audience, while also reflecting the evolving consumer and financial landscape. The cumulative page views on the Centre’s website for all article content has increased 66% this year, surpassing 25,000 views (25% of total site content) and has achieved an average time on page of 2min 19sec for article engagement.

Making financial counselling more accessible

This year we have continued to take an active interest in promoting financial counselling for ADF members and their families through career focused education sessions and by overseeing a 3-year Financial Counselling Trial for serving and ex-serving members.

The Trial commenced on 1 July 2023 and is entering its second year. We anticipate that the final trial evaluation report, due in 2026, will assess the value of financial counselling services specifically offered to serving and ex-serving members and guide the direction of future ongoing financial counselling services.

It is part of our mission to continue to educate members about financial counselling so that they know where to get help when they need it so they can continue in their career and live their best life.

Professional financial counsellors provide free information, advice and advocacy without conflict to assist people in debt to make informed financial decisions. You can get to a financial counsellor by calling the National Debt Helpline on 1800 007 007 or by contacting Bravery Trust on (03) 9957 5755.

As with the community at large, ADF members and their families are experiencing financial difficulty due increased cost of living and, at times, are falling into unexpected debt. Sometimes people enter the ADF with existing debt as a result of challenging life situations. There are a range of practical steps that members and families can take in these circumstances. Getting to a debt solution early is the key to success. It involves negotiation, communication and having a money plan.

The Centre’s task to educate members is supported by being able to assist members and their families in financial distress to achieve financial stability through information about and links to financial counselling.

We know that financial stability means members are more effective and focussed in their career and more resilient in their life.

Brochure on Personal Financial Advice

One of the more common enquiries the Centre receives is how to go about finding a suitable licensed financial adviser. Responding to this high level of interest, we have produced a two page guide which outlines the key issues to consider in this process. Issues covered include the ADF Financial Advice Referral Program, the importance of understanding the cost and scope of financial advice and the reimbursement of certain professional fees for transitioning members. The brochure also includes a list of resources to assist members and their families in developing an understanding of the financial advice industry and in finding a suitable adviser.

ADF Financial Advice Referral Program - Adviser Education

The ADF Financial Advice Referral Program (the Program) was established by the Centre in 2015 to offer ADF members and their families access to licensed financial advisers throughout Australia. All of the advisers in the Program have declared in writing to Defence that they do not receive any third party commissions, percentage-based fees or other product-base incentives. As a result, they avoid remuneration-based conflicts of interest that have been a source of poor behaviour in the financial advice industry.

Over the last two years, the Centre has collaborated with the Commonwealth Superannuation Corporation (CSC), the trustee of the military superannuation funds, to provide a series of online technical education sessions for advisers in the Program. The topics have included an outline of the military superannuation system, details of the Military Superannuation and Benefits Scheme (MSBS), ADF Super and a discussion of case studies which highlight key technical issues in the schemes. These sessions have also allowed advisers in the Program and the relevant people at CSC to create a communication network on key technical issues which regularly arise within the superannuation arrangements of ADF members and their families.

Some Professional Development for our Team

Last but not least, our team including the Chair and our Director successfully undertook some professional vocational education - the Financial Literacy Skillset - at the end of 2023. This qualification is the standard for financial literacy educators (or ‘financial capability workers’ in the current parlance) in Australia. Completing the skillset will help ensure that the financial education we provide for members and their families continues to represent best practice.