How does Economic Policy affect our lives? Recommended Reading.

May 2, 2024

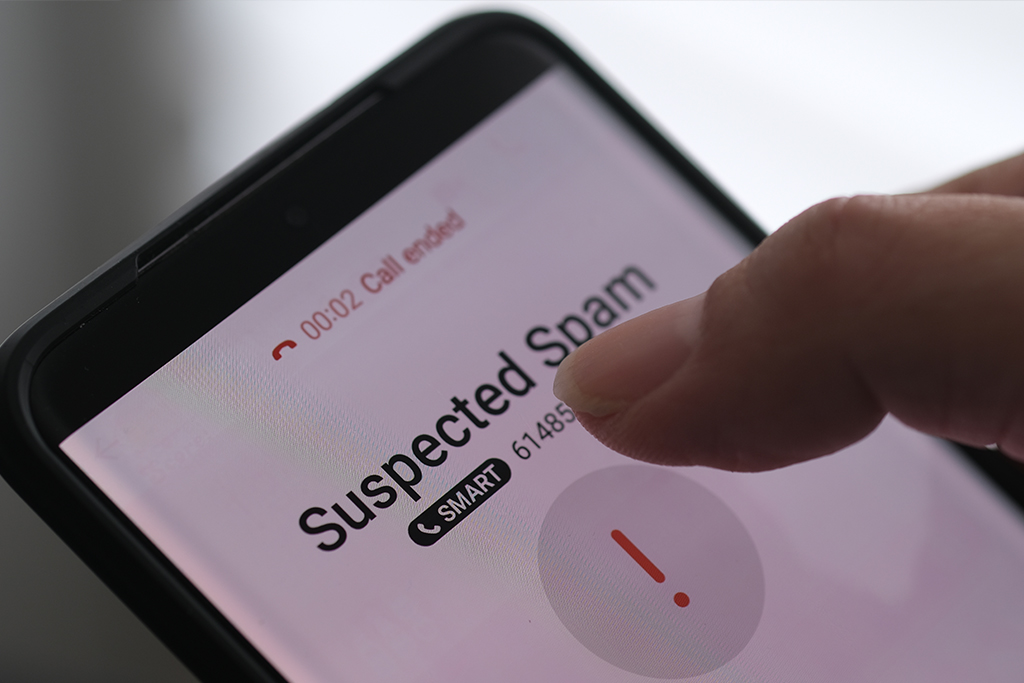

Scams: Be aware, protect yourself and act if you think you’ve been scammed!

June 4, 2024How to find the best deal on car insurance is one of the most common questions we receive at the Centre. So we’ve brought together a buying car insurance guide in this short article with four important links to review before signing up to an insurance policy that you may later regret.

The first and most important question to ask yourself is whether you can afford car insurance. If you can’t, you should seriously consider selling your car or not buying one in the first place. That’s because the economic risks of having an “at fault” accident without insurance coverage are immense. Do you really want to take the risk of paying for unspecified and open-ended damage unintentionally caused by you to another person’s vehicle and/or to other property like a fence or power pole?

If the answer to the question as to whether you can afford car insurance is ‘yes’ (or a qualified ‘yes’ based on quotes), the following article should be helpful.

More information on our website

The section of our website on car insurance is a good place to start. It covers many of the issues we’ve been asked about over the years by ADF members and their families who are considering insuring a car. The page on buying a car is more of general interest, but includes reference to the importance of insurance and the different issues to consider when buying a new or second-hand vehicle.

Both links contain case studies based on actual (sometimes sobering) experiences of ADF members.

Choice

The Australian Consumers’ Association (aka Choice) is a highly recommended source of information because it enables you to confidently compare the features of at least 40 car insurance policies on the market in Australia. Unlike this one, the problem with many comparison sites is that they have commercial arrangements with insurers, so you can never be sure about the value of what you’re being told.

MoneySmart

The Australian Securities and Investment Commission’s website MoneySmart is also an excellent source of independent information on insurance and many other personal finance topics. There is a series of brief articles on car insurance (things to look for etc.). You may have read the messages before, but we recommend reviewing them before signing up to a car insurance policy.

The “best deal”

The final point here in our buying car insurance guide (once you’ve decided you can afford to buy car insurance) is to remember that the cheapest insurance isn’t always the best. You’ll find out whether your insurer offered you a good deal when the times comes to make a claim. That’s why the reputation of the insurer, the features of your policy and the experiences (good and bad) of colleagues and reviewers like Choice can be helpful. Also, there is something to be said for sticking with an insurer and building a track record as a good customer, rather than chopping and changing every year to save a few dollars. You should not overestimate the importance of brand loyalty, but it can be of some significance when it comes time to make a claim.