Property market FOMO

March 9, 2021

Choosing a Financial Adviser

April 7, 2021If you’ve been watching the property market rise recently you might be thinking you need to get in quick before you miss out, or that with interest rates so low it’s a great time to buy an investment property. Don’t get caught up in the hype. Buying a property is a big commitment. Take the time to consider your needs both now and into the future, before you jump in.

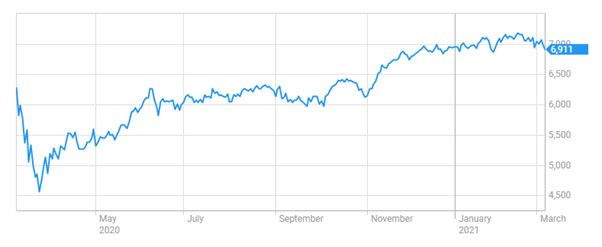

When investing in shares, consider the bigger picture. As a long-term investment shares have historically had higher returns, on average, than other asset classes. The chart below demonstrates how, over the past year, the Australian share market still generated positive returns, even after the fall in value the COVID-19 pandemic caused. Despite all the ups and downs along the way, the market returned 6.78% over the last year.

Australian ALL ORDS 1 year, +6.78%

Source: https://www2.asx.com.au/. This is a measure of share market performance as a whole market. Results of individual shares may differ.

Investment fundamentals

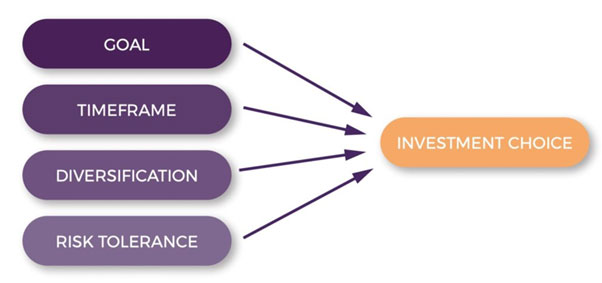

If you’re thinking about investing, keep in mind the fundamentals of any investment;

- What’s your investment goal – what you are saving for?

- What’s your timeframe – how long will your money be invested?

- What investments do you already have – is it different from other assets you own, helping you diversify your risk across different assets classes?

- How tolerant are you of calculated risk– does it pass the ‘sleep at night’ test?

Choosing shares

When you buy shares in a company you become a part owner of the company and are entitled to a share of the profits (or losses) of that company. Companies usually distribute profits as dividends, and if the company grows in value, your shares will likely increase in value.

If you are choosing individual shares, research companies you are interested in and think about reducing your overall risk by buying shares in different companies, across different industries and even across different markets.

An alternative to direct share investing is to buy units in a share fund, such as a managed fund or exchanged traded fund (ETF). This allows you to pool your money with other investors and have it professionally managed by an investment manager.

To learn more about investing, read our investing money guide or visit the ASX website for more free online education.