Fake News and Inappropriate Advice – ASIC Warnings

July 13, 2021

Spring clean your finances

October 8, 2021For many of us, 2020 was a tough year, but it was pretty lucrative for scammers. With an increase in the number of people not working or working from home, and increased online activity, the COVID-19 environment provided a target-rich hunting ground for scammers. Scamwatch reports that last year Australians lost over $850 million to scams.

Who do scammers target?

Scammers target people of all ages, backgrounds, and income levels. There is no one group of people who are more likely to become victims of a scam. However, some groups of people appear to be more susceptible to certain types of scams. For example, men reported higher losses to investment scams, while women were more likely to fall victim to a romance scam. Young people 25-34 reported the highest number of losses to scams, however people over 65 reported higher dollar losses.

Last year, for the first time, Victorians experienced the highest losses of all states and territories, most likely because

they spent more time in lockdown than anyone else.

Popular scam tactics

Compared to 2019, 2020 saw significant increases in losses to:

- Online shopping scams – up more than 52%.

- Remote access scams – up more than 74%.

- Classified scams – up more than 96%

- Threat-based scams – up more than 178%.

- Health and medical scams – up by a whopping 2,080%.

Here’s how some of 2020’s more popular scams worked.

Puppy scams

COVID-19 changed how people lived and with people spending a lot more time at home, the demand for puppies, and puppy prices, increased significantly. Scammers used fake websites, classified or social media ads, to pretend to sell popular breeds of dogs. Scammers relied on state border closures, travel bans, and social distancing measures to stop buyers seeing the animal in person. It also allowed them to scam people twice, once for the cost of the puppy, and then again for transport costs.

The safest way to protect yourself is to only buy or adopt a pet you can meet in person.

Vehicle sale scams

Scammers also used COVID-19 restrictions to facilitate vehicle sale scams, including cars, caravans and campervans. Scammers used legitimate websites such as Facebook marketplace, Gumtree, Car Sales, and Autotrader to pose as buyers and sellers.

When posing as a seller, scammers sometimes pretended to be serving in the military in a remote location, using a fake military email address (for example, @royalairforce-gov.com), which most members of the public would not recognise as fake. They would offer to use military transport to get the vehicle to the seller and suggest using a third party escrow service to hold the funds until vehicle arrives with the buyer. In reality, there is no third party, the money goes directly to the scammer.

Just because an ad is on a legitimate website, doesn’t mean it’s not fake. Don’t pay for expensive goods you haven’t physically inspected.

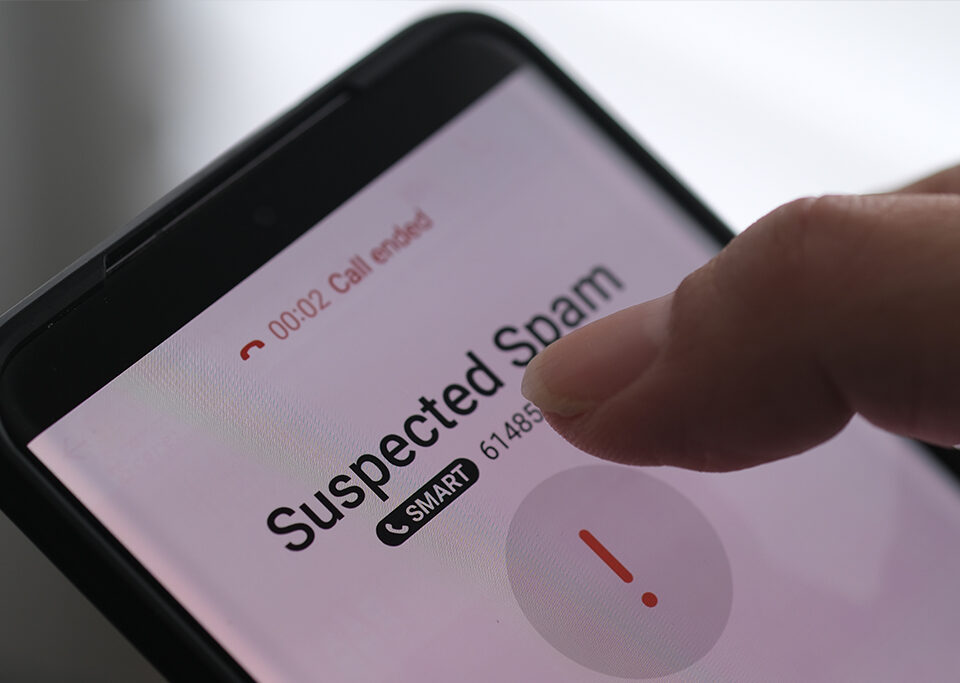

Phishing scams

Phishing scams are aimed at stealing your money or personal information. In this type of scam, victims receive an email or text message impersonating a well-known company or government agency, which looks legitimate. It claims there is an issue and advises victims to click on a link to fix the issue. The link takes the victim to a fake website where they provide personal information such as date of birth, bank details, tax file number, etc., which the scammer then uses to impersonate the victim to obtain money in the victim’s name.

Some of the more popular ruses in 2020 included pretending to be from:

- The Australian Tax Office (ATO) – particularly in relation to the early release of super under temporary COVID-19 access measures.

- Amazon – claiming a fraudulent purchase had been made on their Amazon account, or their Amazon Prime free trial was running out. This typically then became a remote access scam.

- Financial institutions – scammers impersonated a number of banks in order to obtain banking details from victims.

- PayPal – various scams involving PayPal accounts.

- Netflix – claiming subscription payment details had been declined, or were about to expire, and needed updating.

Investment scams

Last year reports of losses to investment scams totalled $328 million, with scammers increasingly taking advantage of social media to make first contact with victims, often involving the purchase of Bitcoin or other cryptocurrencies. Scammers also use methods such as cold calling victims claiming to be a stockbroker or portfolio manager, offering hot tips and share promotions via email or message forums, promoting investment seminars promising access to experts, and posing as financial advisers offering early access to super.

The Australian Securities and Investments Commission (ASIC) is also concerned about the growing number of online influencers offering financial product advice, without being licensed to do so. See our article on fake news and inappropriate advice for more information.

Protect yourself

Unfortunately we live in an era where it pays to be sceptical. Here are some tips to help keep you safe:

- Educate yourself on popular scams by visiting the Scamwatch website.

- Do not give out personal details unless you made first contact with the organisation.

- Always consider that unsolicited approaches via email, text message, social media, or any other format, could be a scam.

- Do not open suspicious texts, pop-ups, or click on attachments. If you think it could be legitimate, contact the organisation using details you have searched for yourself.

- Don’t give someone remote access to your computer, unless you have made first contact and you can verify who you are talking to.

- Keep personal details secure by locking your mailbox, shredding important documents you no longer need, keeping passwords and PINs in a safe place, and being careful about the personal information you share on social media.

- Review your privacy and security settings on social media sites.

- Be wary of requests for personal details or payments.

- Be careful when shopping online and think twice before using virtual currencies such as Bitcoin.