AI CHATBOTS AND YOUR TAX RETURN

August 18, 2025

OPTIMISING YOUR SUPERANNUATION – SOME SIMPLE TIPS

September 1, 2025Getting it right the first time

In this article, we’re offering a range of tax time educational resources that should be of interest to ADF members and their families.

Australian Taxation Office (ATO) Guide for ADF Members

Whether you prepare your own tax return or use the services of a registered tax agent/qualified accountant, we recommend you should review the tax guide prepared by the Australian Taxation Office especially for members of the ADF.

That way you can be satisfied you’ve claimed all the tax deductions to which you’re entitled and haven’t inadvertently overlooked any income that you should have disclosed.

If you’re using the services of a registered tax agent/qualified accountant, draw their attention to the guide. They’re most likely to be aware of it, but no harm is done by double-checking.

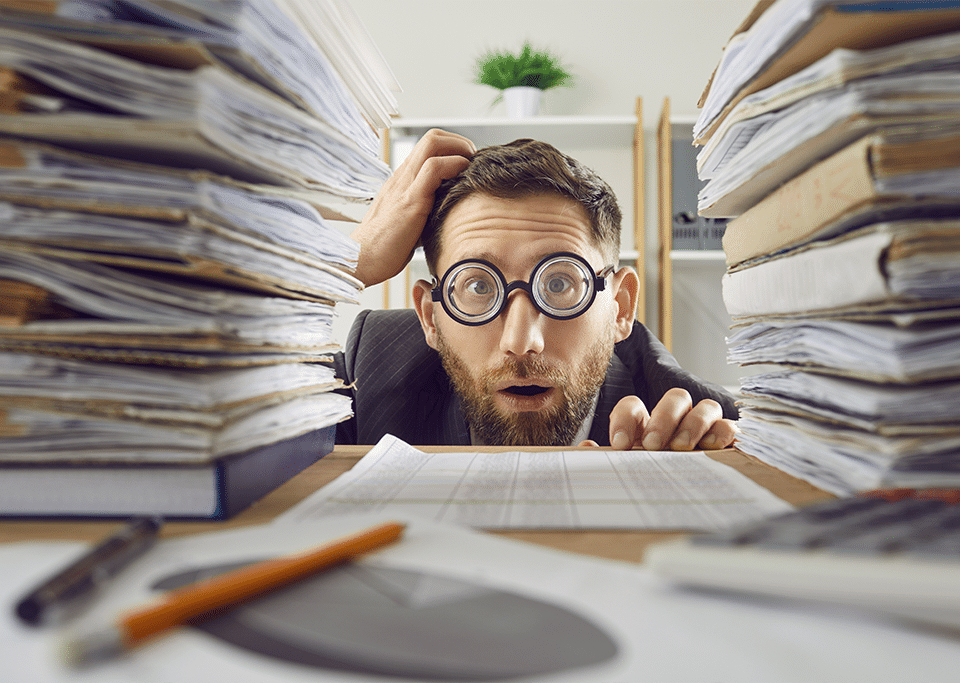

We can assure you that an audit from the Australian Taxation Office is not a pleasant experience. It can result in fines, penalty interest and lots of wasted time.

So why not get it right the first time?

ATO Tax Time Toolkit for Investors

Tax issues around investing can be confusing and daunting, especially capital gains tax and deductible expenses. First time investors commonly make mistakes, sometimes to their financial detriment, often by under-claiming. Others assume they don’t have a tax liability, only to find out years later that they do.

This ATO tax time toolkit for investors is designed as a resource for anyone earning money from investments, whether it’s property, shares or crypto assets. The tax consequences arising from crypto investing/trading is a much misunderstood area for first time investors, so if you’re a crypto enthusiast, reading the ATO toolkit is highly recommended.

ATO Rental Properties Guide

ADF members are enthusiastic investors in property. However, we know from the ATO that thousands of Australians make costly mistakes when it comes to making claims against rental income.

That’s why the ATO makes a point every year of examining the claims by property investors in potentially contentious areas such as repairs/maintenance (generally treated as deductible) vs rebuilding (generally treated as non-deductible capital expense)… but the tax treatment so much depends on circumstances.

Therefore, we recommend property investors should read the ATO Rental Properties Guide. You’d be wise to assume that you’ll be asked searching questions by the ATO at some stage during your period of ownership, especially if you have a large portfolio. So why not be knowledgeable and well-prepared before the inevitable event? Pay special attention to capital gains tax and legitimate deductions against rental income.

Resources from our Website

Here are two articles from our website that may assist you during tax time. The first is a list of top tips to optimise your tax position in 2025. The second is about understanding what an accountant/registered tax agent is and does and how to identify a suitable service provider. You can also explore tax related articles and other helpful resources on our Income Tax page.

Keeping Records

There’s no compulsory methodology or computer system that taxpayers must use to keep details of tax deductible expenses. One option we recommend you should consider is the myDeductions tool offered by the ATO.

This will at least ensure that complete records and documentation of all your deductible expenses are kept in an orderly fashion, in the same place and in the correct format. We stress that you aren’t required to use the ATO’s service, but it certainly has some significant advantages.

Take our tax quiz

Having reviewed the contents of this article, you might like to take our income tax quiz. It’s a short test (seven questions) designed to test your basic understanding of the Australian income tax system, including lodgement dates and some key technical areas raised in this newsletter.