Supporting the Defence Reconciliation Action Plan

November 30, 2021

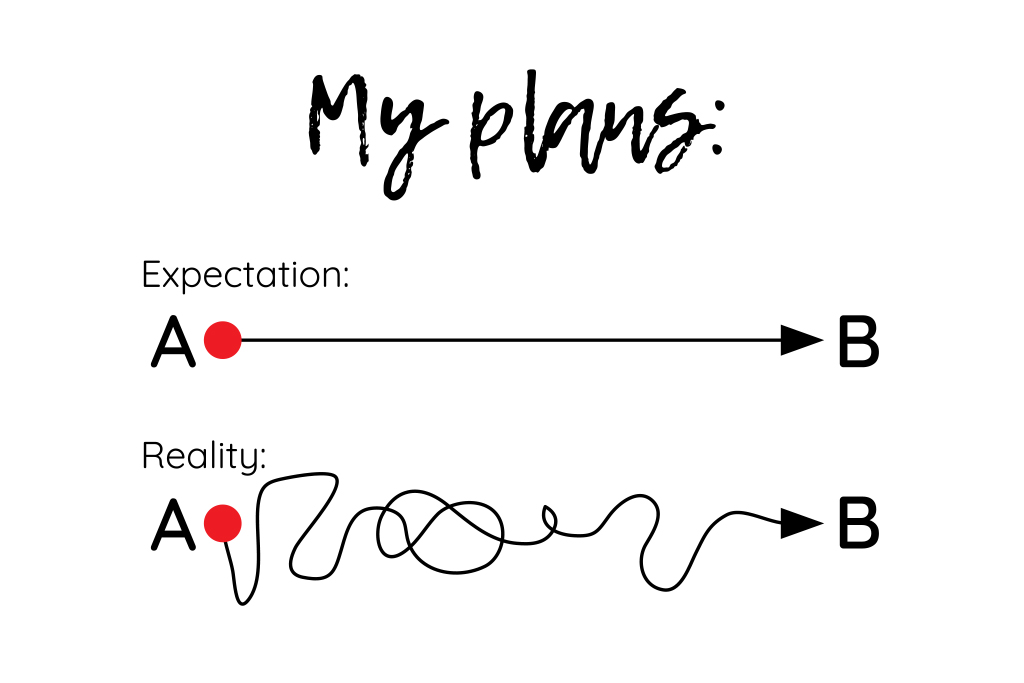

Life has changed…

February 4, 2022We’re often asked during our education programs about how to start an online investment portfolio. Here are some tips to get you underway……

Choosing the right investments will depend on a number of factors:

- Investment goal – Do you have something specific in mind, or is this a rainy day fund or to supplement your superannuation?

- Timeframe – Do you have time to ride out market fluctuations? Share investments usually suit goals that are 5+ years away, whereas shorter timeframes require flexibility, for example, if the market had a downturn, can you wait for the upswing so you don’t lock in a loss?

- Diversification – Are the proposed investments different from other assets in your current portfolio? Diversification across different assets, classes and markets helps to lower risk.

- Tolerance for risk – Do your investments pass the ‘sleep at night’ test?

- Understanding – Do you understand how different types of investments work?

Choose investments

In addition to purchasing direct shares online, you can invest online in assets like real estate, infrastructure, cash, bonds and currency through managed investment funds such as exchange traded funds (ETFs) and Australian real estate investment trusts (A-REITs):

- Direct shares – Research companies you are interested in, including share price movements and how much is typically paid in dividends. This option requires more time for initial research and ongoing monitoring.

- ETFs – You buy units in a fund and the fund buys the shares. An investment manager chooses and manages the investment for a small fee. This option requires much less time and skill, and provides instant diversification within a single investment.

- A-REITS – Similar to ETFs only instead of buying shares, the fund buys real estate. These give you exposure to different types of property such as commercial, retail and residential.

Buying investments

Having decided what to buy, you will need an online trading account, also known as a broking account. Opening a trading account is similar to opening a bank account. Most of the big banks have their own trading account offering, but there are also a number of cheaper online trading accounts available. You can compare online trading accounts using a comparison website. Type ‘compare share trading account’ into your search engine to find comparison websites. Check a couple, as they won’t cover the whole market, and be mindful that comparison sites may receive compensation for listing or linking to a particular trading platform.

Any investment that can be bought and sold on the ASX will have an ‘ASX code’ which you will reference when buying and selling securities. After you have opened a trading account and transferred money into it, all you will need to do is select the investment you want and make the trade.

Fees and taxes

Some trading accounts charge ongoing fees and many charge a ‘brokerage fee’ every time you buy or sell (trade). Before opening an account check all possible fees because, in the long run, ongoing fees can add up to much more than one-off brokerage fees, unless you are trading frequently.

Choose investments carefully as you may pay fees every time you buy or sell which could eat into your capital if you trade too often. Any profits you make (capital gains) will be added to your income and taxed at marginal tax rates, however, if you hold the investment for more than 12 months, only half the gain will be taxable.

Tips

- Investment markets fluctuate, especially in the short-term, so be prepared for the value of your investment to go backwards from time to time.

- Understand the risks and costs involved in regularly buying and selling, sometimes called ‘stock picking’ (if you can get your decisions right more than 50% of the time, you’ll be doing well).

- Borrowing money to buy investments, sometimes called margin loans, adds substantially to your risk, so think carefully about your position should the market fall and the lender asks for some or all of your loan to be repaid.

- Never invest in something you don’t fully understand.

- If you aren’t confident about choosing your own investments, consider paying for professional advice (our website has guidance on choosing a financial adviser).

Need more information? Check out the ASX Investor Education Centre.