What’s in your credit report?

October 8, 2021

Travel safe this summer

November 3, 2021If lockdowns have boosted your bank balance because you’re not spending money on things like entertainment and holidays, are you better off making extra mortgage repayments or investing it in the hope of getting a better return?

In this article we explore the pros and cons of each option, assuming you have $50,000 in cash, a separate emergency fund, and no high-interest debt.

Making extra mortgage repayments

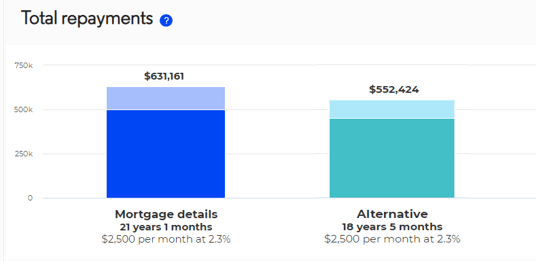

Let’s take a $500,000 mortgage at 2.3%, with current repayments of $2,500 a month. If the mortgage has a redraw feature or an offset account, then leaving the money in the offset account or paying it off the mortgage, could save you $78,737 over the course of the loan and cut 2 years and 8 months off the loan period. That represents a significant risk-free saving.

On the downside, you are effectively only earning a mortgage rate of interest on your savings and they have no chance for capital growth.

Investing in the share market

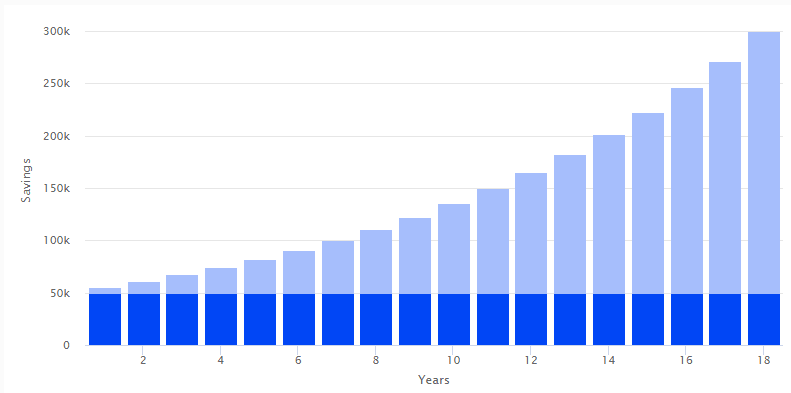

Using the example above, if you took the $50,000 and bought units in an exchange traded fund (ETF), invested in large companies, with a long-term average return of 10% after fees, after 18 years, assuming you reinvest dividends, you could potentially have over $300,000.

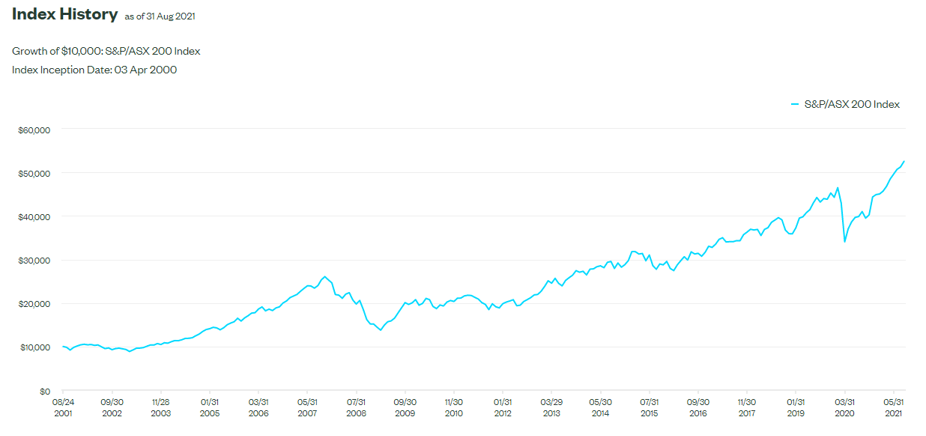

On the downside, markets can be unpredictable and you will be taking on more risk. There is no guarantee that markets will perform in the future, as they have in the past.

The graph above shows how a simple calculator estimates investment growth, the graph below shows the actual growth of the ASX200 market index over 21 years. The ASX200 is an index that tracks the 200 biggest companies on the Australian sharemarket.

If interest rates rise in the future, you can always sell your investment and pay the lump sum off the mortgage.

There is no right or wrong answer to the mortgage vs investment question. Paying the mortgage is a virtually risk-free option that will have you debt free sooner, while an investment carries a risk that you could lose some or all of your money, but you could also be significantly better off. The decision will take into account your needs, goals and objectives, and willingness to take on risk.

Don’t forget, you could always hedge your bets and do a bit of both.