The Perverse Impact of Financial Incentives: Watch this film

June 4, 2024

What to do if you get a sudden windfall

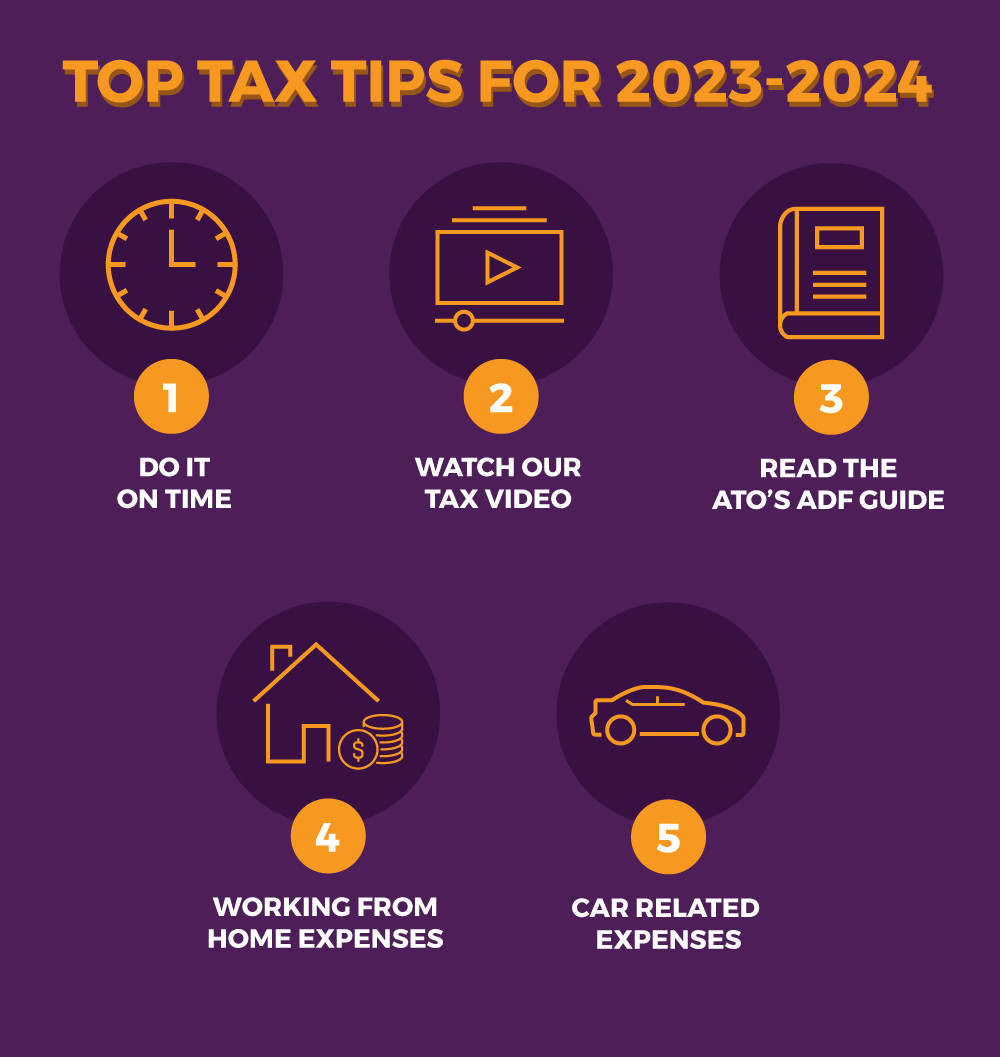

July 1, 2024Here are our top 14 tax tips for 2023-2024:

Tip 1: Do it on time

If you’re completing your own tax return through the myGov portal, it must be lodged by 31 October. Most of your data should be automatically pre-filled by the end of July, so all you need to do is check that the details are correct, add in your legitimate deductions and submit.

Make sure you include investment income (e.g., dividends, interest and rent), gig/cash economy income and capital gains or losses (e.g., on the sale of an investment property, shares or cryptos).

If you are likely to miss the deadline, a registered tax agent (RTA) should be able to lodge your return for you later than 31 October, provided you register with an RTA before that date.

Tip 2: Watch our tax video

For a quick introduction to your income tax obligations, watch our short video Pay Your Taxes (4 minutes). It’s designed to help ADF members better understand the tax system, including their rights and obligations.

Tip 3: Read the ATO’s ADF Guide

The Australian Tax Office (ATO) guide for ADF members explains what income must be declared and what expenses are allowable as tax deductions.

Work-related deductions could include car or travel expenses, uniform expenses, mess fees, self-education expenses, home office and certain fitness expenses. You shouldn’t make a claim unless you’ve actually spent the money and you haven’t been reimbursed.

Tip 4: Working from home expenses

It’s been reported that over 5 million Australians claimed working from home expenses in recent years. That’s a significant proportion of the workforce.

Claims for working from home have become more common since the Covid pandemic. The rules/methods for making these claims have changed over the years which (depending on your circumstances) may improve your tax position.

In 2023, the ATO announced further changes to working from home deductions.

For example, you are no longer required to have a dedicated office space in your home under the revised rate method of making a claim. However, the rules concerning actual hours worked have tightened, so you’ll need to consider whether your record keeping is adequate.

From 1 March 2023 onwards, taxpayers do need to record the total number of hours they work from home.

Tip 5: Car related expenses

Car expense claims by taxpayers are many billions of dollars each year. Therefore, it’s hardly surprising that the ATO is especially keen to ensure that claims are documented and legitimate.

A key point here is that you can’t claim private usage expenses, such as travelling direct from home to work and back. You can read the full details on the ATO website.

Tip 6: Investment properties

According to the ATO, nine out of ten rental property investors make “mistakes” in their tax returns, especially in relation to interest deductions. A senior ATO official has stated: “we see people refinancing their loans and then using the refinancing amounts for private expenses…such as buying a car or going on a holiday…..what we’re saying to people is that interest needs to be apportioned for the private expense”.

Other areas of focus by the ATO include people renting out their home through Airbnb and not declaring the income and/or overlooking the possibility that selling a property in which you’ve rented out a room may be subject to capital gains tax. The latter can be a complex area for ADF members, so it’s worth seeking professional advice if you’re in doubt about your tax obligations. See more below about getting advice.

The ATO website has details of the tax deductible claims you can make as the owner of an investment property.

Tip 7: Cryptocurrency trading

It’s been reported that over 1 million Australians buy and sell cryptocurrency each year. It’s not surprising that the ATO reminds taxpayers “if you sell, swap or exchange cryptocurrency there are capital gains tax consequences that arise from those transactions”. Therefore, it’s important for you to check your crypto transactions (profits or losses) in your pre-filled tax returns with the ATO or through your accountant/registered tax agent portals.

Tip 8: Keep records

Only make claims that you can prove with written records (e.g., receipts). While our tax system is basically an honour system (aka self-assessment), the ATO’s data matching software, which includes comparing your claims to those of your peers, is very efficient.

Taxpayers are selected at random every year for an audit and if you’ve made larger claims than your peers you may be flagged for closer scrutiny. You won’t necessarily be asked every year to provide evidence of your claims, but you should be prepared in case you are. Making false or undocumented claims can lead to substantial fines and regular audits of your tax affairs in following years.

Tip 9: Get help if you need it

If you’re not confident about preparing your own tax return or you need specialist advice, consider using a registered tax agent (RTA), or a qualified accountant if your tax affairs are complex.

To establish that the person or organisation you choose is registered, or to find an RTA in your area, use the search function on the Tax Practitioners Board (TPB) website[SJB1] . You can search for a suitable accountant through a professional body, such as CPA Australia or the Chartered Accountants Australia New Zealand.

Tip 10: Understand fees and charges

There are hundreds of options available when choosing a RTA/accountant. When choosing a provider, make sure they are familiar with the tax deductions available to ADF members and make sure you understand their fee structure which should be a flat fee or hourly rate, not a percentage of any tax refund to which you’re entitled.

Tip 11: Be organised

The more prepared you are the less an RTA will cost. RTAs and accountants generally charge for the preparation of your tax return by reference to the time they spend on it, so being organised can save you money. If you collect random disorganised receipts and hand them over in the proverbial “shoe box” or can’t provide evidence to justify the claims you want to make, you’ll end up paying far more in professional fees or will receive a tax refund which is lower than it should be.

Fees, most of which should be tax deductible, can vary substantially (starting at about $90, up to many thousands), depending on the complexity and time spent on your affairs. So the more organised you are, the lower your fees should be.

Make sure you understand up-front how much you’re going to be charged. That way, you’ll avoid unpleasant surprises and disputes.

Tip 12: Watch out for investment spruikers

Some RTAs and accountants may also be licensed financial advisers, mortgage brokers or real estate promoters, or they may be part of a network promoting these services. These operators may offer to do your tax return for “free” or at a heavily discounted rate, in return for your agreement to undertaking a “financial health check” or even signing up to the purchase of products from which they will earn commissions or incentives.

So be aware of the motives of these advisers before you engage them to prepare your tax return. They may not be acting in your best interests.

Tip 13: If you’re late, don’t wait

If you haven’t lodged a tax return for prior years, we recommend you lodge the outstanding return(s) voluntarily, rather than getting caught by the ATO. That way, penalties will generally be lower and arrangements may be made to pay off any outstanding tax in a manageable way. In many cases, you could be entitled to a refund, so lodging outstanding returns may even turn out to be a financially pleasant experience.

Tip 14: Use your refund wisely

If you are fortunate enough to receive a substantial tax refund, use it wisely. An unexpected windfall like this could be used to pay off high-interest debt, set up an emergency fund, or be used to start a savings plan for a larger purchase you may want to make in the future. Consider sitting on your refund for a short time while you carefully think through your options to really make the most of the opportunity.

Should you need more help or assistance with any of these issues, contact us and consider subscribing to our monthly newsletter which covers tax and other significant consumer issues.

You might also like to read the article from last month’s newsletter on maximising your 2024 tax refund. It contains some additional material on tax planning options prior to June 30 that might be of interest. Most of it will still be relevant in the 2024-2025 tax year.