Life has changed…

February 4, 2022

Making Home Ownership a Reality

March 7, 2022Have you started the year with a Christmas / New Year debt hangover? Or maybe it’s about time you showed your finances some love? If you haven’t started the year feeling like a money maestro, here are a few tips to get your 2022 finances off to a good start.

Deal with debt first

If you overspent during the New Year period and find yourself with a credit card balance or a few too many buy-now-pay-later debts, make paying these off a priority. There is no point putting money away in a savings account if you are paying a high rate of interest and/or fees on debt.

Start by prioritising debts. What are the minimum repayment amounts and when are they due? Make a list if you have more than one debt, seeing it on paper will make the timeline clearer. When you are confident you can at least meet minimum repayments as they fall due, use any spare cash to make extra repayments, starting with any debt that is charging you interest (highest rate first). Review your budget to see if there are any areas you can make savings to free up cash.

Refresh your budget

A budget is an information source that helps you make the most out of the money you have. The start of the year is a great time to refresh your budget. Income and expenses change over time, keeping your budget up to date helps you plan and make decisions about what’s important.

Using a tool like the budget calculator can make the budgeting task a lot quicker and easier. If you download the Excel version, you can update your budget easily whenever your circumstances change.

Plan ahead

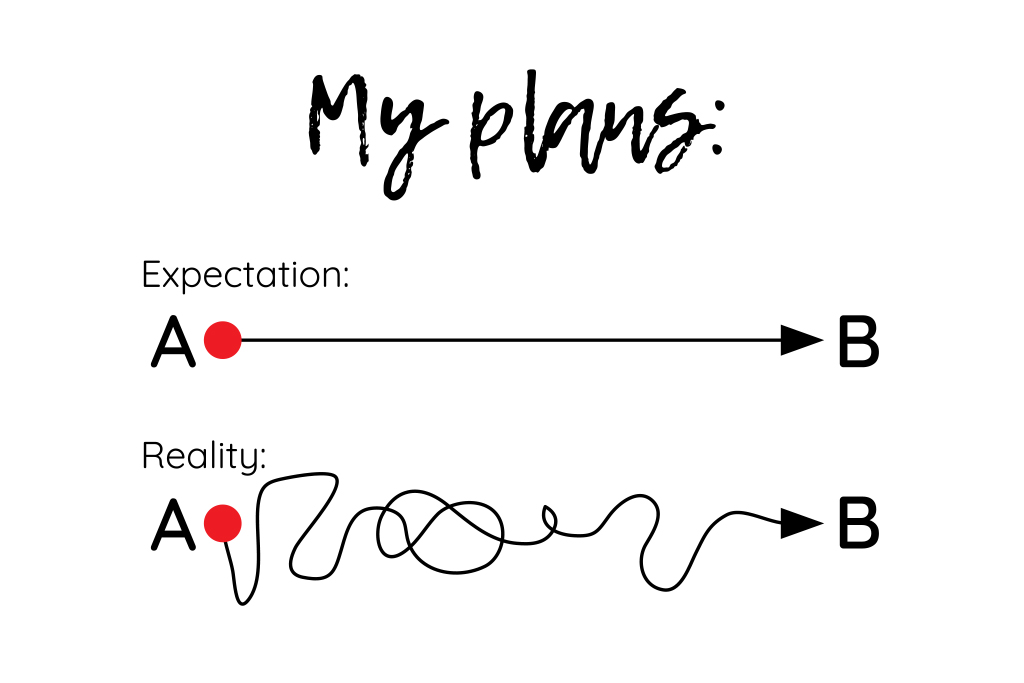

If you’re trying to reach a financial goal (or two), having a plan will help you stay on track and get you there faster. Think about what you want to achieve in the short, medium and long-term. Write it down. Estimate how much it will cost, and how long it will take you to save. Moneysmart has a savings goals calculator that can help you work this out quickly. Your budget will tell you how much is left each pay to put towards your goals.

Here’s an example of a savings plan for a couple with a starting balance of $10,000 and $800 available each pay to save. If you do have a partner, make sure you’re on the same page when it comes to goals and saving.

Make it happen

Separate savings from your bills and spending accounts so you can see the progress you are making and will be less likely to accidentally spend it. Savings for shorter-term goals are probably best kept in a savings account, but you might reach longer-term goals faster if you invest your cash.

If you need help starting down the investing path, start with the ‘Investing’ section of the ADF Financial Services Consumer Centre ‘During career’ guide.