PET INSURANCE IN AUSTRALIA: SHOULD YOU? SHOULDN’T YOU?

July 30, 2025

TAX TIME EDUCATIONAL RESOURCES

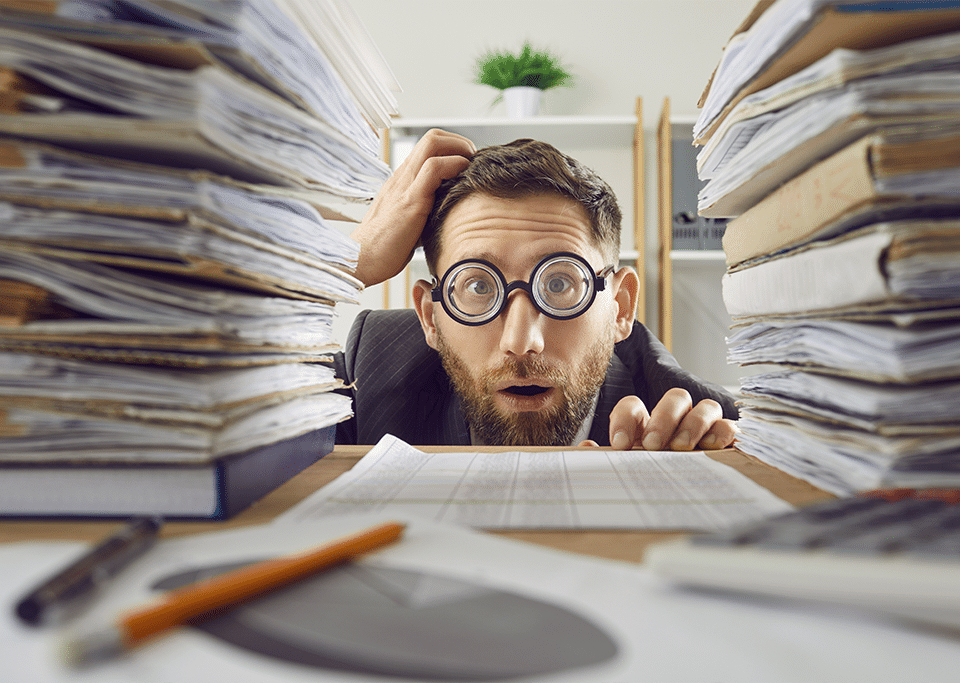

August 18, 2025One statement we can make without fear of contradiction is that most Australians don’t enjoy preparing their annual tax return.

So it’s hardly surprising that many of us are wondering whether “Artificial Intelligence” (AI) could be the answer we’ve been looking for to avoid the unpleasant annual chore of poring through piles of dog-eared, faded receipts and bank statements in the hope of maximising our tax refund.

We’re hoping that by “employing” some form of AI app which scans, categorises and creates order from chaos, our tax returns will be done more efficiently, faster and correctly, not to mention cheaper, due to our newly found ability to avoid the (generally tax deductible) fees of a registered tax agent (RTA). Some of us are hoping to access discerning AI chatbots that can authoritatively explain the application and meaning of tax laws to our personal circumstances and unravel potentially complex problems that might otherwise require the services of an expensive professional adviser.

Here’s where we need to manage expectations and issue warnings about the unqualified use of so-called “generative AI chatbots” to assist with tax returns and related tax issues.

Recent Changes

AI chatbots may offer out-of-date information and may not reflect changes and the latest interpretations of tax laws. For example, one of them recently responded to a question about the approved limit on concessional superannuation contributions in Australia with an answer that was correct in the year ended 30 June 2024, but failed to include the fact that the limit had increased for the year ended 30 June 2025.

Therefore, taxpayers who relied on this source as authoritative would have incurred significant additional amounts in income tax, without recourse.

Personal Tax Advice

Tax laws are complex and vary significantly between countries, states and other legal jurisdictions. These laws often require considerable experience and professional judgement in their application.

Therefore, AI chatbots cannot be relied upon to generate tax advice that is personal and tailored to your unique situation. So if you do ask an AI chatbot for the answers to your tax problems, we recommend that you treat the answer with scepticism and double-check it with an independent, trusted source, such as the Australian Taxation Office website.

Security/Privacy

Your tax return information is private and often involves sensitive and personal information. Typically, AI chatbots claim that they don’t keep any of your data. Nevertheless, you should always think carefully about the information you disclose and to whom.

To say the least, the world of AI is fast-developing and potentially litigious. For example, a recent article in “The Hill” (an American current affairs website), was headlined: “The New York Times wants your private ChatGPT history – even the parts you’ve deleted”. The article, reporting on a copyright court case, stated: “soon, lawyers for the Times will start combing through private ChatGPT conversations, shattering the expectations of users who never imagined their deleted conversations could be retained for a corporate lawsuit…..it’s a mass privacy violation dressed up as routine litigation”.

Where this might end, we don’t know. But surely in the meantime, users of AI chatbots should exercise care.

Liability

Unlike Registered Tax Agents (RTAs), AI chatbots are highly unlikely to accept liability and responsibility when they give incorrect information or make mistakes. Therefore, for all practical purposes, in the absence of a RTA, the responsibility, costs and unpleasantness arising from errors or misstatements in your tax return, such as tax audits, additional tax, fines and interest are yours and yours alone. Whether or not your mistakes are intentional is irrelevant.

Just to make this point clear, it’s worth noting the disclaimers displayed on a few AI chatbot sites:

ChatGPT: “ChatPT can make mistakes. Check important info”

Google Gemini: “Gemini can make mistakes, so double-check it”

Microsoft Copilot: “Copilot may make mistakes”.

That’s pretty clear, isn’t it?

Key Messages

Here are some key messages from this article:

- Think twice before entering private tax and financial information into publicly available AI chatbots

- Use reputable, well-known software with proper security, for example, the myDeductions app from the Australian Taxation Office

- If you choose to use an AI chatbot, always double-check responses for mistakes and omissions

- Never treat answers obtained from AI chatbots as professional, personal tax and financial advice

- Ask an expert if you’re in any doubt about an issue, or if your tax affairs are complex.

In that regard, these recent articles from our website on sources of tax advice and optimising your tax position in 2025 may be helpful.

The best piece of advice that can be offered is to….always be a sceptical consumer because no one cares about your personal financial and tax affairs as much as you do.