HOW MUCH TO SAVE FOR YOUR FIRST HOME DEPOSIT? A GUIDE TO CURRENT CHANGES

October 2, 2025

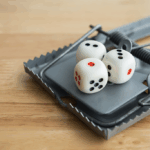

IS IT A SCAM, IS IT GAMBLING? NO, IT’S SCAMBLING!

November 7, 2025Australia has no shortage of wealth creation spruikers. They “sell the dream” in online and face-to-face seminars, while enthusiastically talking up winning investment strategies featuring unending capital gains, financial independence and the dream of early retirement. Especially prominent are those who promise to disclose their unique secrets of success for Australian property investors.

Typically, seminars feature compelling “educators” (read salespeople or promoters) who claim to have made personal fortunes out of property investing and are now willing to freely offer you, a complete stranger, their scientific research-based strategies that have made them rich.

Common messages are that property investments (at least the ‘once in a lifetime’ opportunities they support) are pretty much risk free, will achieve above average returns in the next twelve months (if not sooner) and are sure to make you financially independent in a few short years.

Sometimes, these promoters will claim to have served in the military, implying that they (above all others) can be trusted to act in your best interests. And they will usually offer “live” motivational case studies of ordinary Australians who have made small fortunes with little effort and minimal risk by simply following their advice.

So why would anyone offer these amazing services for next to nothing in return? Could it really be out of the “goodness of their hearts”? Could it be that they respect and value the service of ADF members so much that they are willing to give back something to our community free of charge?

Maybe. But it’s more likely that their comforting rhetoric is a warming-up process. After that, serious amounts of commission can be made by selling (sometimes) over-priced properties on behalf of developers who are commercially connected to the promoters, arranging mortgages for potential buyers, and even selling expensive “property education programs” to members of the public who are keen to learn the hitherto secret formula for on-going success in the property market.

In order to sweeten the deals, properties promoted in the seminars will often include “rental guarantees” and discounts for buying “off-the-plan” during the seminar program. For example, if a “rental guarantee” of 5 years is offered, ask yourself who is paying for the guarantee? It’s unlikely that the seller will be paying. Could it be that the buyer is actually paying for the guarantee through an excessive price on the property? The same point applies in the case of discounts for buying “off-the-plan”. It’s unlikely that the discounts will be generous and may not even be genuine discounts at all.

So, while we encourage ADF members and families to develop sensible investment plans, many of which involve property acquisitions, here are some key messages to consider:

Take your time

Never make a significant financial decision in the heat of the moment, especially at a seminar where the atmosphere is exciting and motivating and does not encourage rational thinking.

Get it in writing

Before making a commitment from which you can’t back down, ask for a detailed written outline of the deal that’s being proposed, especially its income and expenses, both now and down the track for, say, at least 5 years (or the term of your loan, whichever is the greater). This should include all commissions and incentives to the promoter.

Seek a second opinion

Seek a second opinion, perhaps from a licensed financial adviser whose values and principles align with the ADF Financial Advice Referral Program. This will cost you money, but it’s likely to give you some assurance that you’re on the right (or wrong) track with your investment. Make sure that when you approach a financial adviser you understand the cost and scope of proposed advice before proceeding (advice can be expensive).

Check online reviews

Check online reviews by other consumers. This is by no means a foolproof basis on which to form an opinion, but it can be a factor in your “due diligence” of the deal.

Check regulators’ registers

Check if the promoter’s name (or a company associated with the promoter) appears in:

- the Australian Securities and Investments Commission’s (ASIC) Connect professional registers (under banned and disqualified)

- the Australian Competition and Consumer Commission’s (ACCC) undertakings register

- the website of your state’s or territory’s consumer affairs and protection agency.

Do a stress test

Property is a long-term investment. Contrary to the enthusiastic claims of promoters, property can (and does) go up and down in value and those movements are impossible to predict with certainty. Therefore, it’s important to carefully manage your level of debt and stress test your ability to make repayments should your circumstances change.

Ask yourself the following “what-if” questions:

- What if I or my partner lose our jobs or suffer a major drop in income?

- What if I or my partner become ill and couldn’t continue to work?

- What if I or my partner die?

- What if we start a family?

- What if interest rates rise significantly?

- What if property values drop as a result of a recession?

- What if I discharge from the ADF?

- What if I can’t find a tenant or they stop paying their rent?

- What if my property suffers extensive uninsured damage due to the behaviour of tenants, floods, storms or other uninsured events?

Clearly, not all (or even, any) of these events will necessarily happen, but a sensible property investor will always ask these questions before signing a contract and will consider what their fallback position might be if any of these events were to occur.

Don’t be a victim of FOMO

Remember the golden rule of investing…. if a deal looks too good to be true, it probably is. Therefore, do not be hurried into making a decision that you may live to regret. Do not be a victim of FOMO (Fear of Missing Out). One thing that can be absolutely guaranteed is that there will always be another property available (many others in fact) when you’re ready to make a commitment.

It’s also worth noting that in addition to the Australia-wide network of local real estate agents, there are many “boutique” specialist property advisers and mortgage brokers who don’t offer “education” programs, but nevertheless sell the merits of buying and financing property through them (often creating trust by promoting an ADF “connection”).

We’re not suggesting that these people are unethical, however, we are saying that you should understand how they are paid and how that might influence the advice they offer.

This does not necessarily mean that the advice is wrong or inappropriate, however, when considering its merits, you should always take your time and assess if it is offered with your best interests in mind.

Like to learn more?

Our website contains a guide to investing which expands on a number of the themes in this article (and more).