SELLING THE DREAM – TIPS FOR SENSIBLE PROPERTY INVESTORS

October 2, 2025

TRAVEL MONEY CARDS COMPARED…WHICH ONE IS BEST FOR YOU?

November 7, 2025With the arrival of the Spring Racing Carnival and all the excited (and no doubt commercially motivated) media coverage encouraging us to ‘have a punt’ and wear a somewhat ridiculous yet ‘fascinating’ hat, for some reason, we thought it might be timely to write again about gambling or scambling. We have previously covered topics including the odds of developing a gambling problem and the potential dangers of gambling using credit. This time we wanted to alert our readers to something even more ruinous than the likely losses from regulated gambling: Scambling.

What is scambling?

So, what exactly does the delightful little portmanteau ‘scambling’ mean? You may ask. Basically, it refers to illegal online gambling whereby the consumer (or victim really) is frequently unable to claim any purported winnings and/or is unwittingly involved in money laundering or assisting the scammers’ scheme to fleece other unsuspecting people.

How does scambling work?

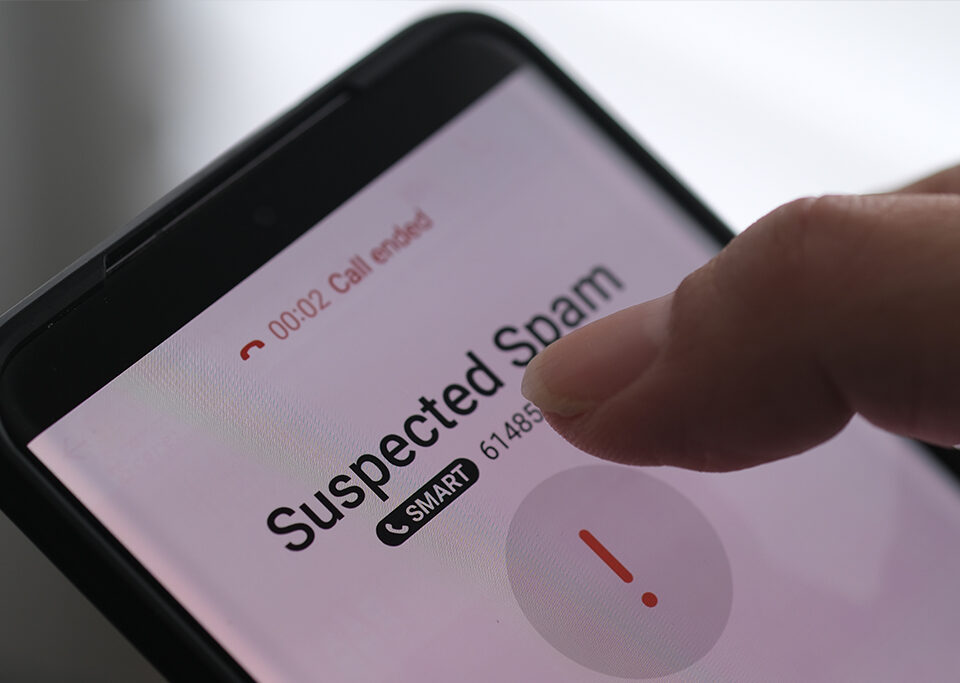

Generally, consumers are lured in through social media influencers, chat groups or people they have some sort of connection with online. They are enticed to engage with a legitimate looking gambling website or download an app (of note, some illegal gambling apps have even found their way onto reputable app stores). As with lots of different types of scams, the sophistication of these illegal platforms has reached such a level that they may be difficult to distinguish from the legitimate regulated ones they are imitating.

The consumer will likely be asked to deposit money into a bank account using PayID in order to play a range of online games. These bank accounts may change frequently. It will seem that they are earning ‘winnings’. The twist is of course that the consumer is extremely unlikely to ever receive their ‘winnings’ or to get any of their money back at all. Sadly, according to recent press reports, vulnerable consumers have been especially targeted.

Don’t pay the middleman

Another, if it’s possible, even more nefarious feature of scrambling operations is that the people referring others may be receiving a commission for each referral and even a percentage of the losses that those people make! They may also receive payments from the scammers if they allow their bank account to be used for receiving payments from victims and laundering those payments by forwarding them to a third party account. This is all, of course, likely to lead to energetic promotion of scambling operations by those who seek to share in the ill-gotten gains. You should exercise caution regarding any unsolicited promotion you may receive about a gambling site or app.

Where can I find out more and get help?

The national anti-money laundering regulator AUSTRAC has recently launched a campaign against scambling as part of their Fintel Alliance initiative. Resources include guidance on what to do if you think you have been scambled. South Australia’s Consumer and Business Services also offers clear succinct guidance on what scambling is and what you can do about it.

On scams more broadly, Scamwatch – run by the National Anti-Scam Centre – is an excellent source of information and advice on what to do about all things scam. Scamwatch discusses gambling and betting scams under the broader category of investment scams because they invariably have the common feature of promising big returns only to leave the victim with nothing or maybe even debts.

If you or someone you know is worried about the effect gambling is having, the Australian Gambling Research Centre provides details of where you can get help.

More generally, our ADF Consumer Centre website has information about where you can get help with money problems including those related to gambling.